Introduction: The New Era of Smarter Real Estate Investing

In Alberta’s evolving real estate market, the conversation isn’t just about buying property; it’s about buying smarter.

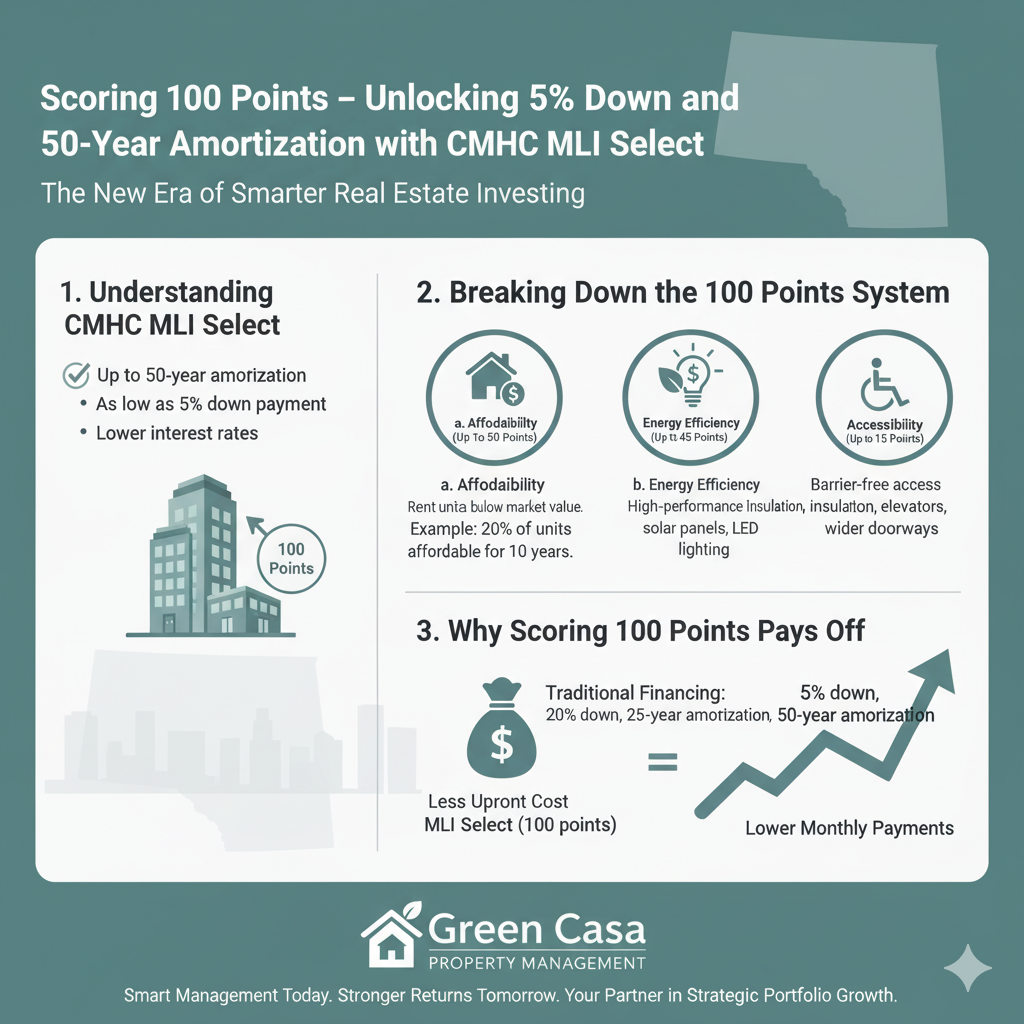

One of the biggest shifts reshaping the investment landscape today is CMHC’s MLI Select program, a financing model that rewards investors for building or owning rental housing that is affordable, energy-efficient, and accessible.

And the prize?

Up to 50-year amortization terms, as little as 5% down, and lower insurance premiums the kind of flexibility that can make the difference between a good investment and a great one.

In cities like Calgary and Edmonton, and surrounding towns like Airdrie, Chestermere, Cochrane, Okotoks, and Strathmore, investors are using MLI Select to transform new and existing multi-family buildings into high-performing, cash-flow-positive assets.

1. Understanding CMHC MLI Select: What It Really Means for Investors

MLI Select (short for “Multi-Unit Mortgage Loan Insurance Select”) is CMHC’s upgraded financing program for multi-family residential properties such as 4-plexes, 12-unit apartment buildings, or even new rental developments.

The program uses a point-based system.

Each property can score points in three categories:

- Affordability

- Energy efficiency

- Accessibility

The higher your score, the better your financing terms.

At 100 points, you unlock the best benefits:

✅ Up to 50-year amortization

✅ As low as 5% down payment

✅ Lower interest rates and insurance premiums

This means you can dramatically reduce your monthly costs and boost your cash flow, all while contributing to more sustainable and inclusive housing across Alberta.

2. Breaking Down the 100 Points System

a. Affordability (Up to 50 Points)

This measures how many of your units are rented below market value, and for how long.

For example, if you commit to keeping 20% of your units affordable for at least 10 years, you could earn up to 40 points.

💡 Example:

In Airdrie or Chestermere, you could build a small 12-unit apartment, rent 3 units at 80% of market rent, and instantly score high for affordability while still earning steady, long-term income.

b. Energy Efficiency (Up to 45 Points)

This category rewards properties that use less energy and emit less carbon.

Features that help include:

- High-performance insulation and windows

- Energy-efficient HVAC systems

- LED lighting and smart thermostats

- Solar panels or renewable energy sources

In Calgary’s Killarney or Renfrew, new infill builders are already using advanced materials and designs that meet these requirements, giving investors a head start on their MLI Select scores.

c. Accessibility (Up to 15 Points)

Accessibility points are awarded to properties that include barrier-free access and adaptable design features.

This might include wider doorways, elevators, ramps, or flexible layouts that can accommodate different tenant needs.

In developing towns like Okotoks and Cochrane, new multi-family builds are increasingly designed with seniors and families in mind, naturally ticking the accessibility box while broadening their rental appeal.

3. Why Scoring 100 Points Pays Off

Here’s the exciting part:

With 100 points, you unlock elite financing that can completely change your numbers.

Let’s say you’re purchasing a 10-unit building in Mount Pleasant, Calgary, worth $2 million.

- With traditional financing: 20% down ($400,000) and a 25-year amortization.

- With MLI Select (100 points): 5% down ($100,000) and a 50-year amortization.

That’s $300,000 less upfront and nearly 40% lower monthly mortgage payments, freeing up thousands in cash flow each month.

This enables investors to grow more quickly, reinvest their profits, and expand their portfolios, all while supporting Canada’s housing objectives.

4. How Alberta Investors Are Using MLI Select

Alberta is ideal for this type of financing.

Why?

- No rent control: Flexibility to adjust rents annually to match market trends.

- Lower property taxes: Easier to maintain a strong cash flow.

- Population growth: Calgary and Edmonton are welcoming record levels of in-migration.

In Strathmore, developers are using MLI Select to build energy-efficient 8-plexes targeting family renters.

In Renfrew, investors are converting aging fourplexes into modern, accessible units that meet the program’s accessibility and energy targets.

It’s not just about better financing, it’s about smarter, future-proof investments.

5. Green Casa’s Role: Turning Programs Into Performance

At Green Casa Property Management, we don’t just manage properties, we manage potential.

Our team helps investors identify which upgrades, designs, or features can maximize MLI Select points while maintaining healthy ROI.

We handle:

- Property analysis for eligibility

- Coordination with lenders and builders

- Post-construction management to protect your cash flow

Because in the right hands, a CMHC-backed property isn’t just an investment, it’s a legacy.

Conclusion

The MLI Select program is changing the rules of real estate investing and Alberta is leading the way.

By aiming for 100 points, investors can unlock 5% down, 50-year amortizations, and unmatched stability in a growing, landlord-friendly market.

With the right property, the right strategy, and the right management like Green Casa, you’re not just investing in real estate; you’re investing in the future of Alberta’s housing market.