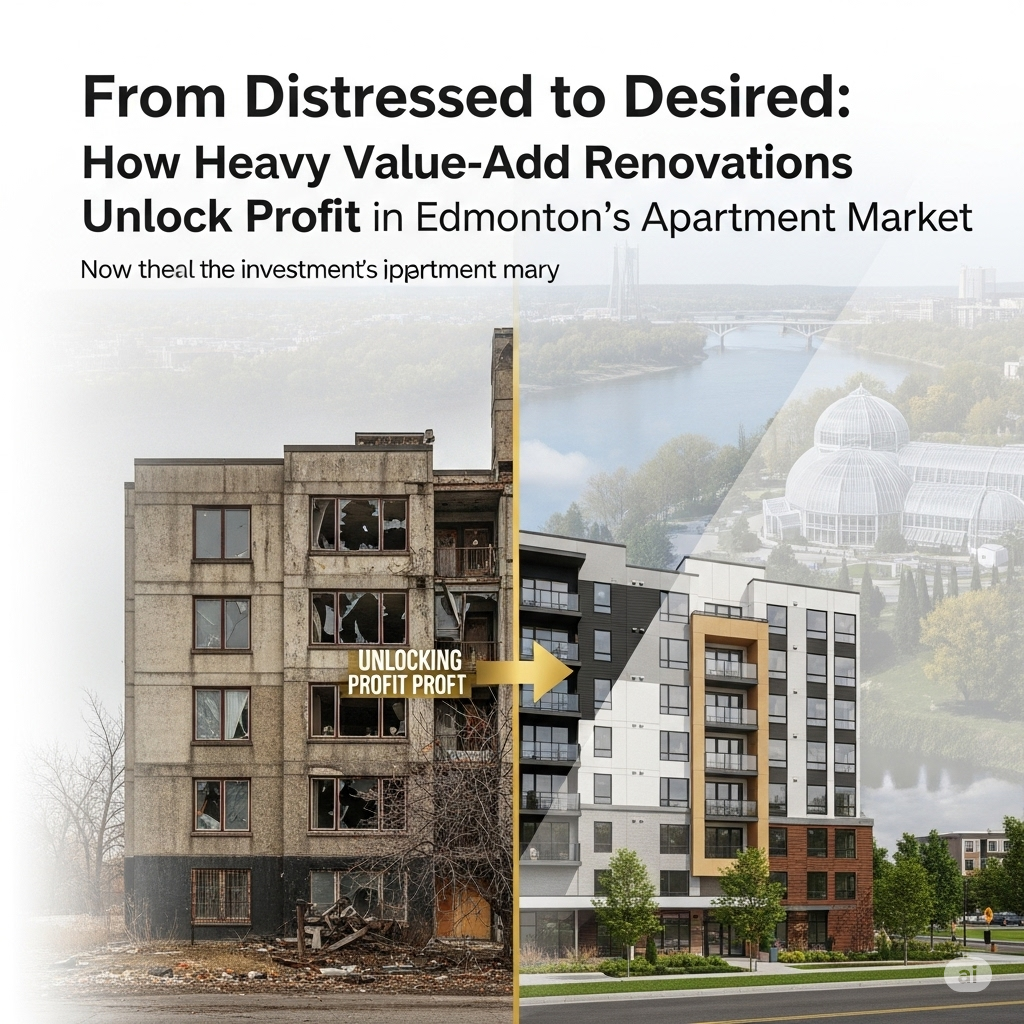

When most people think of real estate investing, they picture buying a shiny new building or a well-kept property that’s “tenant ready.” But some of the biggest profits in Edmonton’s apartment market come from properties that look like they’ve seen better days.

This strategy known as heavy value-add investing, focuses on purchasing underperforming or distressed apartment buildings, then renovating them to significantly increase both rental income and property value. It’s not for the faint of heart, but for investors willing to take on the challenge, the rewards can be transformative.

Why Heavy Value-Add?

Edmonton’s apartment market is full of older stock. Many buildings were built decades ago and haven’t been upgraded in years. That means investors can purchase them at a discount compared to newer properties.

For example, a building with dated flooring, old kitchens, and tired common areas will attract lower rents and often higher vacancies. But with a thoughtful renovation plan, these same units can be repositioned as desirable, modern homes, commanding higher rents and longer tenancies.

The Renovation Playbook

Heavy unit renovations typically include:

- Installing new flooring, cabinetry, and countertops

- Upgrading kitchens with stainless steel appliances

- Adding in-suite laundry (a tenant favorite)

- Refreshing common spaces like lobbies, gyms, and hallways

- Enhancing curb appeal with landscaping and exterior updates

These upgrades don’t just improve aesthetics, they change the tenant profile. Suddenly, you’re attracting working professionals, students, and families willing to pay a premium for comfort and convenience.

Risks to Watch

Of course, heavy value-add comes with challenges:

- Vacancy during renovations: Units need to be empty while work is completed, which impacts cash flow.

- Capital expenditure: Renovations are expensive, and costs can balloon if not carefully managed.

- Execution risk: Poor contractors, unexpected repairs, or city permitting delays can derail timelines.

The Reward: Forced Appreciation

Unlike market appreciation, which depends on external factors, heavy value-add lets investors force appreciation by directly increasing property income. Once rents rise, the building’s overall valuation increases.

In Edmonton, where rental demand is growing thanks to affordability and in-migration, this strategy can deliver outstanding returns.

Final Word

Heavy value-add is not about quick wins, it’s about vision. By seeing potential where others see problems, investors can turn neglected apartments into high-performing assets. In Edmonton’s evolving market, that vision could be the key to unlocking significant profit.