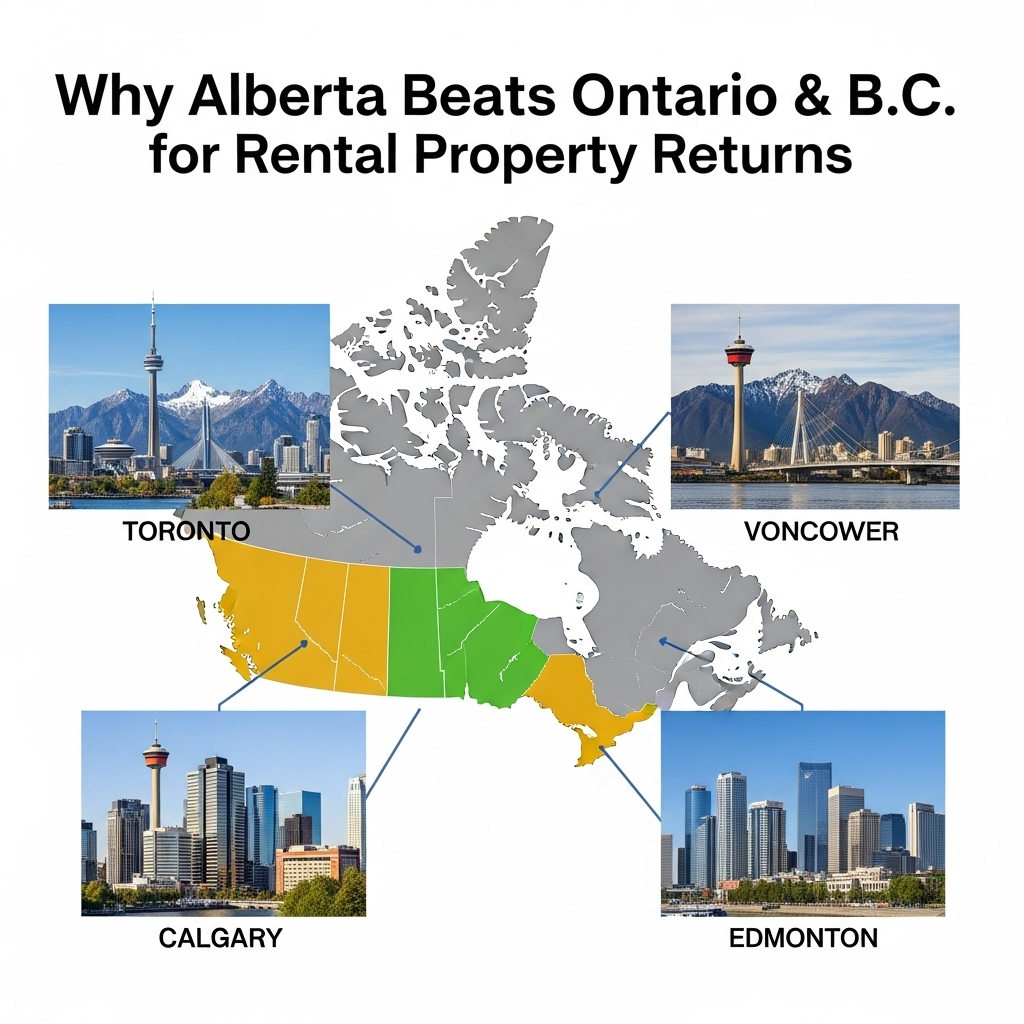

Picture this: you’re in Toronto, Vancouver, or Winnipeg, where the cost of a single-family home often breaks the million-dollar mark. Rental yields are razor-thin, bidding wars are the norm, and strict rent controls leave landlords with little room to breathe.

Now shift the lens westward to Alberta, Calgary’s skyline rising fast, Edmonton’s communities filling with students, workers, and newcomers. Here, multi-family buildings are far more affordable, landlord laws are straightforward, and rental demand is climbing steadily. That’s why more out-of-province investors are planting roots in Alberta’s rental market, and they’re seeing results.

Why Investors Are Turning to Alberta

1. Affordability That Makes Sense

While a duplex in Vancouver might cost $1.2 million, a 12-unit apartment building in Edmonton could fall within the same range. That means higher doors per dollar and the chance to scale much faster.

2. Rental Growth and Low Vacancies

Calgary currently has one of the lowest vacancy rates in Canada. Landlords are benefiting from strong rental growth, as demand continues to outpace supply.

3. A Diversifying Economy

Alberta is no longer only about oil and gas. Tech firms, logistics hubs, universities, and healthcare expansions are fueling job creation. Young professionals, immigrants, and students are all looking for quality rental housing.

4. Landlord-Friendly Regulations

No rent control. Faster dispute resolution. Transparent processes under the Residential Tenancies Act. Alberta’s framework balances tenant rights while ensuring landlords can actually operate their businesses effectively.

The Hurdles for Out-of-Province Investors

Of course, opportunity doesn’t come without challenges:

- Distance Matters – Unlike owning a property down the street, you can’t just swing by to check on a boiler or interview a tenant.

- Local Market Nuances – A “great deal” in one Edmonton neighborhood may be a nightmare in another. Calgary’s suburban growth is very different from its downtown rental demand.

- Hands-On Management – Maintenance issues, tenant disputes, and leasing gaps can become costly if you don’t have a reliable system in place.

Winning Strategies for Remote Investors

So how do out-of-province investors overcome the distance and succeed in Alberta’s multi-family market?

1. Build Your Local Power Team

- Property Manager: Your most important partner. They’ll handle leasing, rent collection, repairs, and day-to-day tenant communication.

- Realtor: Specializes in multi-family properties and understands neighborhood-specific rental dynamics.

- Mortgage Broker: Knows Alberta’s financing environment, including commercial mortgages and CMHC’s MLI Select program.

- Inspector & Contractors: Help ensure the building is solid and renovations are handled properly.

2. Know the City Differences

- Calgary: Higher population growth, slightly higher purchase prices, and a strong influx of young professionals.

- Edmonton: Lower entry costs, strong cap rates, and steady demand from students and government workers.

3. Leverage Equity from Home Province

Many Ontario and B.C. investors refinance properties back home, pulling out equity to buy in Alberta. Since Alberta buildings are cheaper, your dollars stretch further, accelerating portfolio growth.

4. Smarter Financing Options

For buildings with 5+ units, financing is based on property income, not just your salary. This means investors can often qualify for bigger, more scalable opportunities.

5. Show Up When It Counts

You don’t need to be in Alberta every month, but visiting for property inspections, major renovations, or a purchase closing is invaluable. A two-day trip can protect you from years of mistakes.

Alberta: The Investor’s Edge

Unlike heavily regulated provinces, Alberta offers something unique: flexibility. Rent caps don’t strangle landlords, evictions don’t drag on for endless months, and rental growth can keep up with market forces.

This balance creates space for investors to thrive while still ensuring tenants are treated fairly. It’s the kind of environment that encourages long-term success, not short-term headaches.

Final Word

For out-of-province investors, Alberta is one of the last strongholds in Canada where cash flow, appreciation, and scalability align. Whether you’re looking at Calgary’s booming rental demand or Edmonton’s high-yield opportunities, the west offers something that Ontario and B.C. no longer can: the ability to grow wealth through real estate.

With the right team, the right financing strategy, and the willingness to think beyond your backyard, Alberta can turn remote investors into long-term success stories.