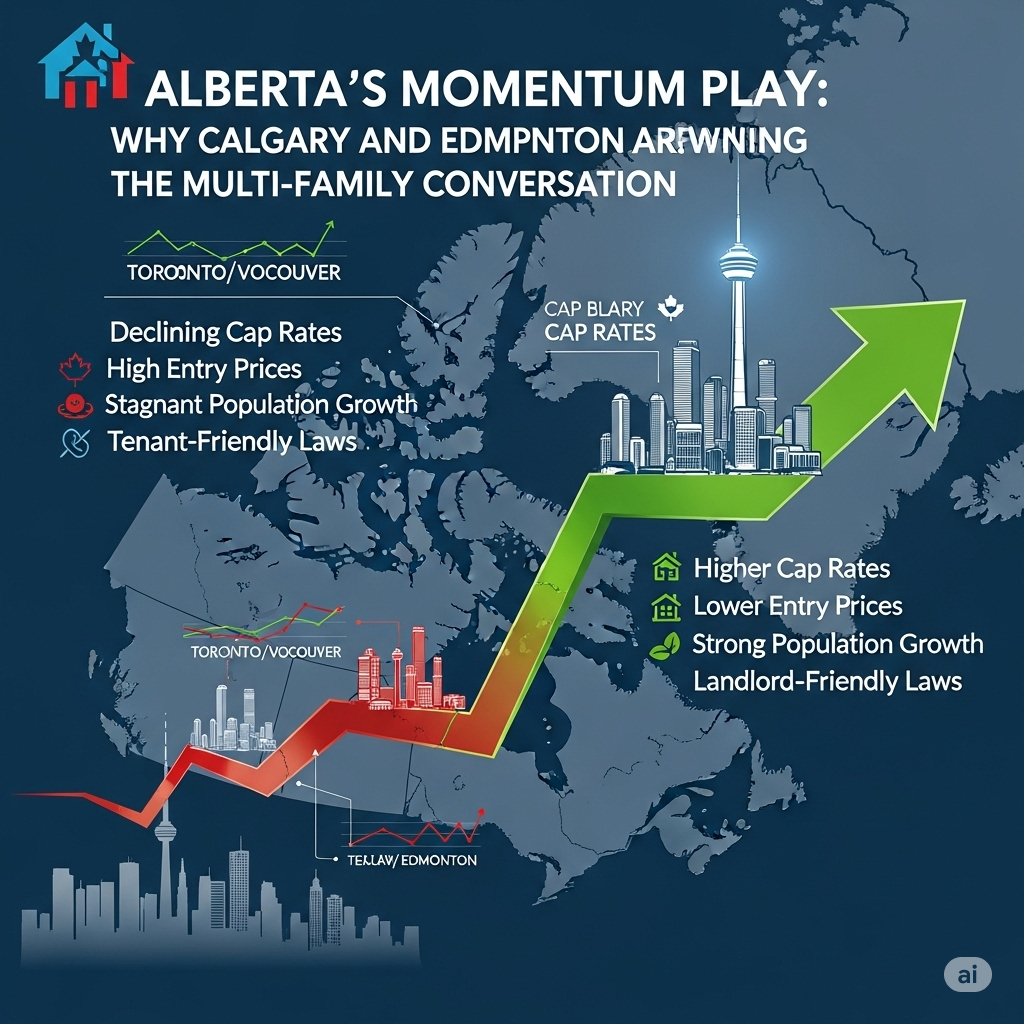

Calgary and Edmonton are no longer the “up-and-coming” kids in Canadian real estate; they’re now firmly in the spotlight. By mid-2024, Alberta’s two major cities accounted for roughly 23% of all Canadian multi-family investment, a massive leap from just 5% two years earlier. That’s not a fluke, it’s a structural shift.

What’s happening in Alberta is more than just a short-term window. It’s a confluence of economic fundamentals, investor-friendly dynamics, and demographic tailwinds that are pushing Calgary and Edmonton onto the national stage. For investors who’ve grown frustrated with razor-thin yields in Toronto and Vancouver, Alberta has become the place where the numbers finally make sense.

What’s Pulling Capital West

1. Cap Rates That Still Work

In Alberta, stabilized multi-family assets often trade in the 5% to 6% cap range, compared with closer to 4% in Toronto or Vancouver. That 100–200 basis point spread may not sound huge, but in practice it’s the difference between:

- Cash flow today vs. negative carry

- Breathing room on debt service vs. constant pressure

- The ability to reinvest in buildings vs. being forced to cut corners

In a rate environment where margins matter more than ever, Alberta’s yields simply pencil better.

2. Entry Prices That Create Real Upside

Per-unit pricing in Calgary and Edmonton remains substantially more affordable than Canada’s major coastal metros. Investors aren’t just buying cheaper assets—they’re buying lower-risk entry points.

For example, while a mid-rise in Toronto might demand $400K+ per door, a comparable property in Calgary may trade at nearly half that. That gap translates into greater resilience during downturns and more headroom for value creation as rents climb toward market.

3. Population & Jobs Driving Demand

Demand isn’t a “what if” in Alberta—it’s happening.

- Migration: Alberta has led the country in interprovincial inflows for two consecutive years. Families, young professionals, and skilled workers are chasing affordability and opportunity.

- Immigration: Federal newcomer targets are feeding directly into rental demand, with Alberta capturing a growing share thanks to its housing affordability.

- Job Growth: While energy is still a cornerstone, industries like logistics, health care, education, tech, and film are diversifying the economic base. More jobs = more households = more tenants.

The result? Vacancy compression, stronger rent growth, and robust absorption, even in newly built product.

4. A Pro-Operator Environment

Alberta is also winning on regulatory clarity. Unlike provinces with blanket rent controls, Alberta allows market adjustments on turnover, letting professional landlords align rents with actual costs and reinvest in their buildings.

The dispute resolution process is straightforward, and ownership rights are clear. This makes underwriting not only easier but also less risky, a major draw for institutional and private investors alike.

What the Numbers Look Like on the Ground

Consider a 12-unit wood-frame walk-up in Calgary, built post-1975 with moderate updates:

- Purchase Price: $2.7M

- In-Place NOI: $155K

- Going-In Cap: ~5.7%

- Value-Add Budget: $180K (common areas + selective suite upgrades)

- Target Rent Growth: 7–10% over 12–18 months

At stabilization, NOI climbs toward $175K, pushing the yield to ~6.5% on cost. Even modest cap rate compression back to 5.5% would deliver paper gains on top of stronger cash flow.

This isn’t a home run; it’s disciplined, repeatable execution. And that’s what makes Alberta attractive: deals that work without over-engineering the pro forma.

Micro-Markets Worth Watching

Calgary

- Beltline, Mission, Sunalta: Urban renter hubs with reliable absorption and consistent turnover opportunities.

- Seton, Mahogany, Evanston: Suburban growth corridors with young families and new infrastructure, supporting long-term demand.

Edmonton

- Oliver, Strathcona, Garneau: University-driven demand plus proximity to downtown, always steady.

- Southwest infill: Newer stock, high-income households, and amenity-driven demand make this a premium rental pocket.

Financing That Accelerates Scale

Alberta investors have another tool: income-based financing. For assets over 5 units, lenders underwrite primarily to the property’s cash flow, not personal income.

Programs like CMHC’s MLI Select can stretch amortizations up to 50 years for qualifying buildings, often with reduced premiums. For investors pursuing phased renovations, this extended amortization smooths out debt coverage and preserves liquidity for capital projects.

The 2025 Outlook

The playbook going into 2025 is clear:

- Competition is heating up. More national capital is underwriting Alberta deals, but pricing still trails the Big Two.

- Yields remain compelling. Even as demand strengthens, Alberta offers a spread that continues to outshine Toronto and Vancouver.

- Tenant experience is key. Operators who focus on tenant service, timely maintenance, and modernized amenities will see better retention, lower vacancy, and more durable NOI.

Bottom Line

Calgary and Edmonton are no longer “alternatives.” They’re core Canadian investment markets. The combination of cash flow today, credible growth tomorrow, and a landlord-friendly environment is unique in the country.

For multi-family investors seeking both resilience and runway, Alberta isn’t just catching up; it’s leading the momentum play.