Introduction: More Home, Less Money

When Canadians think of real estate, Toronto’s glass condo towers or Vancouver’s million-dollar bungalows often steal the spotlight. But savvy investors are learning that Canada’s most compelling opportunities aren’t always in the headlines. Instead, they’re looking west, not to the coast, but to Alberta.

Calgary and Edmonton quietly offer something rare in today’s market: affordability paired with strong earning power. Together, these factors create some of the best income-to-housing ratios in the nation, making Alberta’s two largest cities magnets for both homeowners and long-term investors.

Affordability: The Numbers Don’t Lie

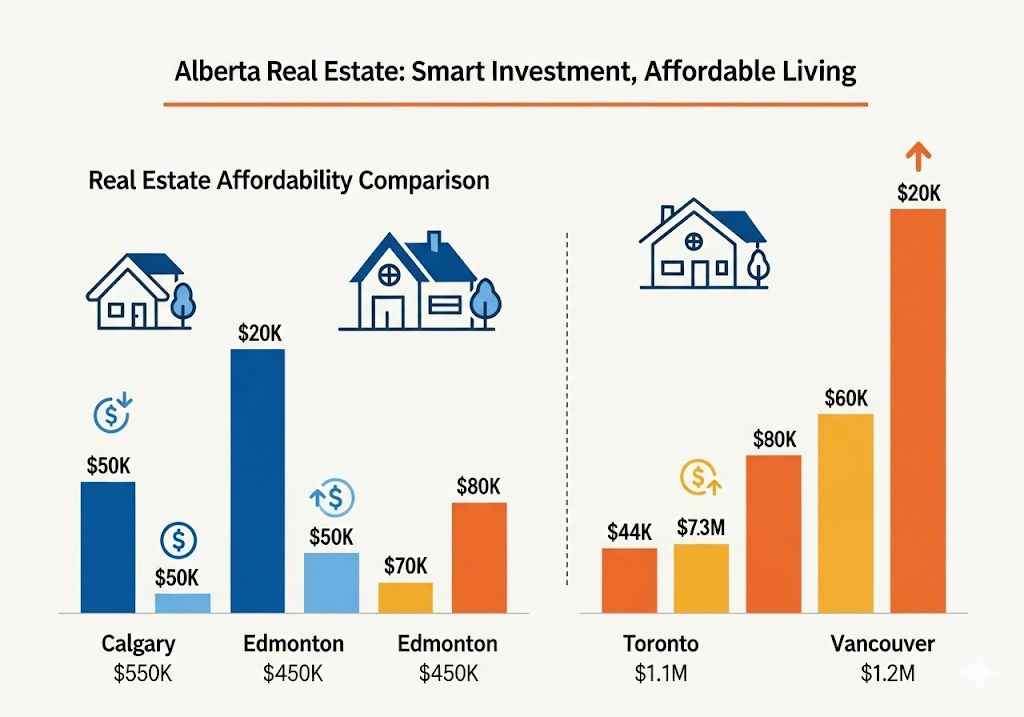

Let’s put things in perspective:

- Toronto/Vancouver MLS Benchmark (late 2022): Over $1.1 million

- Calgary MLS Benchmark (late 2022): About $527,000

- Edmonton Average Price: Just under $400,000

This means:

- For the price of one home in Toronto, you could purchase two in Calgary or nearly three in Edmonton.

- Lower entry prices open doors for investors who want to scale portfolios faster, spread risk, and maximize returns.

In other words, Alberta lets investors do what’s nearly impossible in overheated markets: buy multiple properties while keeping financing manageable.

Income Strength: High Earning Power

Affordability is only half the equation; strong incomes are what sustain real estate markets. Alberta stands tall here, too.

- Calgary’s median after-tax household income: ~$87,000, the highest of any major Canadian city.

- National comparison: In Toronto and Vancouver, incomes often trail far behind housing costs, stretching buyers and renters thin.

This higher earning power translates into healthier rental demand and stronger tenant stability. People aren’t just able to find housing in Calgary and Edmonton; they can actually afford it.

Value Scores: Independent Proof

MoneySense, a respected Canadian publication, ranked Calgary and Edmonton among the best cities for real estate value:

- Calgary Value Score: 3.69/5

- Edmonton Value Score: 3.44/5

These scores place Alberta’s cities among the nation’s leaders for long-term housing value. For investors, this means confidence that the fundamentals aren’t just hype—they’re recognized across the industry.

Why This Matters for Investors

✅ Stronger Cash Flow Potential

Lower property prices mean lower mortgage payments. In many cases, investors can achieve positive monthly cash flow, a rarity in Toronto or Vancouver, where rising costs often push investors into negative territory.

✅ Lower Risk of Market Overheating

Alberta’s markets are steady. While Toronto and Vancouver swing dramatically with booms and corrections, Calgary and Edmonton move more predictably, reducing volatility risk for long-term investors.

✅ Room for Appreciation

With more Canadians chasing affordability and jobs, Alberta’s population is growing steadily. This consistent migration fuels both rental demand and property appreciation over time.

Conclusion: The Smart Investor’s Market

In a country where “affordability crisis” dominates headlines, Calgary and Edmonton quietly stand out as exceptions. Homes remain attainable, incomes are high, and the math works for investors seeking real, sustainable cash flow.

For those willing to look beyond Canada’s most talked-about markets, Alberta offers one of the most balanced and profitable plays in Canadian real estate.

Sometimes the smartest opportunities aren’t found where the spotlight shines brightest; they’re found in Alberta, where affordability, livability, and investability meet