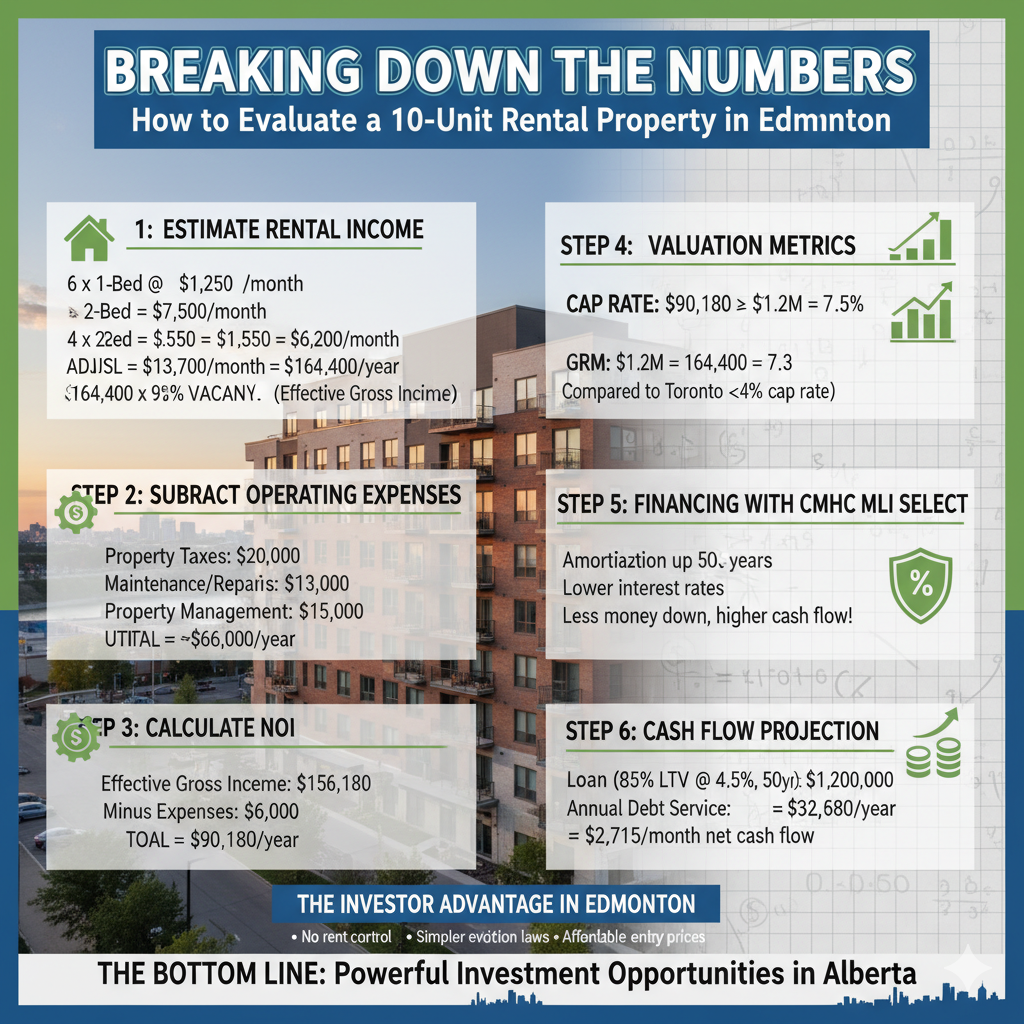

Many investors love the idea of owning multi-family properties, but struggle with the math behind evaluating them. Edmonton, with its affordable entry prices and strong rental demand, is a perfect place to learn how to analyze deals. Let’s walk through an example: a 10-unit apartment building in Edmonton.

Step 1: Estimate Rental Income

Assume:

- 6 one-bedroom units at $1,250/month

- 4 two-bedroom units at $1,550/month

Gross Scheduled Rent (GSR):

- 6 × $1,250 = $7,500/month

- 4 × $1,550 = $6,200/month

- Total = $13,700/month = $164,400/year

Adjust for 5% vacancy:

- $164,400 × 95% = $156,180/year (Effective Gross Income)

Step 2: Subtract Operating Expenses

Typical expenses for a 10-unit building:

- Property Taxes: $20,000

- Insurance: $6,000

- Maintenance/Repairs: $13,000 (approx. 8% of rent)

- Property Management: $12,000 (approx. 8%)

- Utilities (if landlord-paid): $15,000

Total Operating Expenses: ~$66,000/year

Step 3: Calculate NOI (Net Operating Income)

Effective Gross Income: $156,180

Minus Expenses: $66,000

NOI = $90,180/year

Step 4: Valuation Metrics

- Cap Rate: If the property is listed at $1.2M, then:

NOI ÷ Price = $90,180 ÷ $1,200,000 = 7.5% cap rate - GRM (Gross Rent Multiplier):

Price ÷ GSR = $1,200,000 ÷ $164,400 = 7.3 GRM

Both are strong indicators compared to higher-priced markets like Toronto (where cap rates are often under 4%).

Step 5: Financing with CMHC MLI Select

Here’s where Alberta gets even more interesting. With CMHC MLI Select, this 10-unit could qualify for:

- Up to 95% LTV financing

- Amortization up to 50 years

- Lower interest rates than conventional loans

This means lower down payments, lower monthly payments, and higher cash flow.

Step 6: Cash Flow Projection

Assume financing at 4.5% interest, 50-year amortization, 85% LTV:

- Loan: $1,020,000

- Monthly mortgage payment: ~$4,800

- Annual debt service: ~$57,600

Cash Flow = NOI ($90,180) – Debt Service ($57,600) = $32,580/year

= $2,715/month net cash flow

The Investor Advantage in Edmonton

Compared to other provinces:

- No rent control in Alberta → landlords can adjust rents to market annually.

- Simpler eviction laws → easier to manage problem tenants.

- Affordable entry prices → lower per-unit costs, higher cap rates.

This combination makes Edmonton and Calgary a playground for investors ready to scale.

The Bottom Line

A 10-unit building in Edmonton isn’t just a theoretical exercise; it’s a real-world example of how Alberta’s affordability, rental demand, and financing options create powerful investment opportunities.

For investors ready to grow from duplexes to 10 units and beyond, Green Casa provides the guidance, management, and expertise to turn numbers on paper into wealth in reality.