Introduction

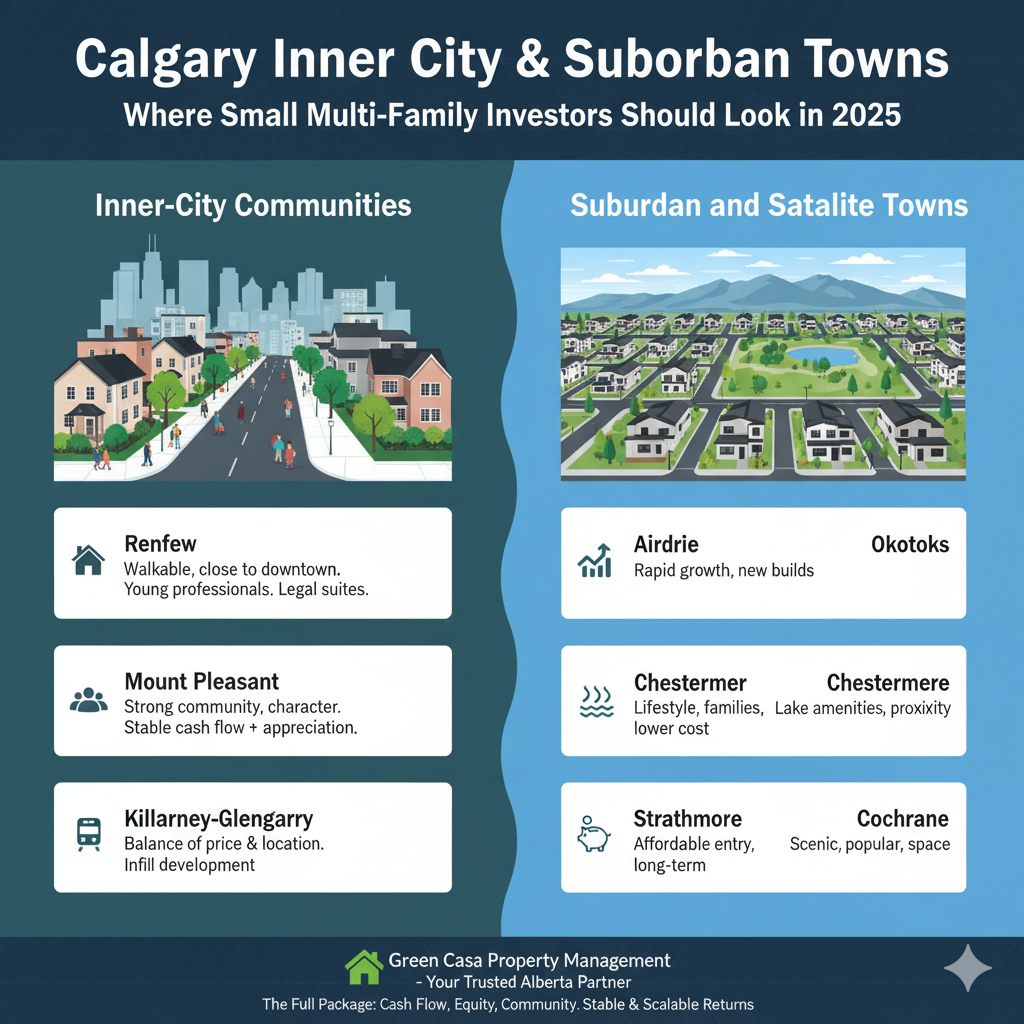

For small multi-family investors (duplexes, triplexes, small fourplexes) in Calgary, picking the right community can make the difference between decent income and outstanding cash flow. Let’s look at several inner-city neighborhoods and fast-growing suburban / satellite towns, including the likes of Airdrie, Okotoks, Chestermere, Strathmore, and Cochrane. We’ll explore where demand is rising, where entry prices are still reasonable, and how to think about investment returns.

Inner-City Communities in Calgary

- Renfrew

- Very walkable, close to downtown, great schools, and parks. High demand for rentals by young professionals and small families.

- Homes in Renfrew are being snapped up, and infill development is active. You can find older homes that need renovation or newer infills. Renovations / adding suites here can help increase rent significantly.

- Investment tip: consider small multi-unit homes or legal basement suites; fix-ups that modernize kitchens/bathrooms tend to yield a big bump in rent.

- Mount Pleasant

- Strong community feel, trending upwards in price, desirable for people who want an inner-city with character.

- Because home prices are already high (average over $1 million for many listings in some parts), net yields may be lower, so focus on units that can produce stable cash flow plus appreciation.

- Killarney-Glengarry

- Offers balance: slightly lower price per unit than the most expensive inner-city, but still benefits of location, transit, and amenities.

- Infill and redevelopment are happening; newer “laned homes” and rebuilt infills can fetch premium rents.

Suburban and Satellite Towns Outside Calgary

- Airdrie: rapidly growing; strong rental demand; many new builds; often lower per-square-foot price vs inner city. Good for small multi-families or duplex/townhome units.

- Okotoks: good for families; people often choose Okotoks for lifestyle and lower housing costs, still close enough to commute to Calgary.

- Chestermere: lake amenities plus proximity to Calgary make it attractive for renters who want a nicer lifestyle. Possibly premium for view/amenity.

- Strathmore: one of the most affordable entry points, good for investors wanting lower entry cost and long-term growth.

- Cochrane: scenic, popular, improving infrastructure; more demand as people seek less density, more space.

What to Look for: Demand Drivers & Return Boosters

- Transit & Access: Proximity to LRT or major roads improves attractiveness. For the inner city, walkability, access to downtown matter. For suburbs, ease of highway access matters.

- Amenities & Schools: Good schools, shopping, parks, and recreation boost rental demand, especially from families.

- Supply vs Demand: New builds sometimes flood suburbs; be careful not to buy where supply is overshooting demand. On the flip side, inner city areas often have limited land → less new supply → which helps keep value.

- Age of Property & Maintenance Costs: Newer suburban homes often have lower upkeep. Older inner city homes might need more maintenance, but they may also be under-priced relative to what rent demand allows after renovation.

Projected Return Comparisons & Scenarios

- In Calgary’s inner city (e.g., Renfrew, Killarney, Mt Pleasant), gross yields for small multi-unit properties may be around 6-7% (sometimes higher depending on pricing and rent), with net yields somewhat lower after expenses.

- In suburban towns like Airdrie or Chestermere, yields may be somewhat lower grossly (say 5-6%), but operating costs and entry costs are also lower, which helps improve net cash flow.

- For example, buying a small duplex in Airdrie may cost far less per square foot than an inner city triplex; even if rent per square foot is lower, your cash flow margin might be better due to lower maintenance, fewer surprises, and sometimes less property tax or municipal fees.

Conclusion

If you are a small investor looking to maximize returns while managing risk, a mixed strategy might work best: pick one property in an inner city neighborhood (for appreciation and prestige + renters who pay a premium for location) and one in a satellite town (for lower cost, more space, less competition).

Green Casa Property Management can help manage both kinds of investments well: from selecting tenants, managing renovations, optimizing rents, tracking operating costs, etc. If you like, I can run local Alberta vs Ontario yield data specific to Green Casa’s typical properties (duplexes, small multi units) for a blog post you can use.