Introduction: Alberta’s Quiet Revolution

While Ontario and British Columbia often dominate Canada’s real estate headlines, a quiet revolution is taking place in Alberta, led by Calgary and Edmonton. Once seen as oil-dependent markets, these two cities are now attracting waves of investors for a very different reason: multi-family investment potential.

In fact, by mid-2024, Alberta’s two major cities accounted for 23% of all Canadian multi-family investment, up from just 5% two years earlier. The shift isn’t random; it’s driven by data, economics, and lifestyle migration. And it’s turning Alberta into one of the most profitable and investor-friendly regions in Canada.

1. The Numbers Behind Alberta’s Surge

Let’s start with some quick facts that explain the hype:

- Rental Yields: Investors in Calgary are seeing average returns between 8–10%, compared to around 3–4% in Toronto or Vancouver.

- Cap Rates: Multi-family properties in Alberta typically offer 5–6% cap rates, meaning stronger cash flow potential.

- Population Growth: Calgary’s population grew 15% since 2020, fueled by young professionals, immigrants, and interprovincial movers chasing affordability.

- Construction Boom: Over 10,000 new rental units were completed in 2024 alone, triple the previous year.

These trends tell one story: Calgary and Edmonton are no longer “up-and-coming,” they’ve arrived.

2. Why Investors Are Choosing Alberta Over Ontario

🏡 No Rent Control, More Flexibility

In Ontario, rent increases are capped at 2.5% (2024), which limits growth potential.

In Alberta, there’s no rent cap, allowing landlords to adjust rates to match market conditions. This flexibility can turn average returns into outstanding ones.

💰 Affordable Entry Prices

You can still find multi-family properties in Calgary and Edmonton for half the price per door compared to Toronto or Ottawa. That lower barrier to entry gives younger investors a real chance to start building wealth faster.

🧾 Lower Operating Costs

With lower property taxes, insurance, and utility expenses, Alberta’s operating margins are simply more attractive. It’s not just what you earn, it’s what you keep.

💼 Economic Momentum

Alberta’s economy is diversifying beyond oil tech, logistics, healthcare, and renewable energy sectors are expanding. That’s creating stable employment and a steady pool of renters.

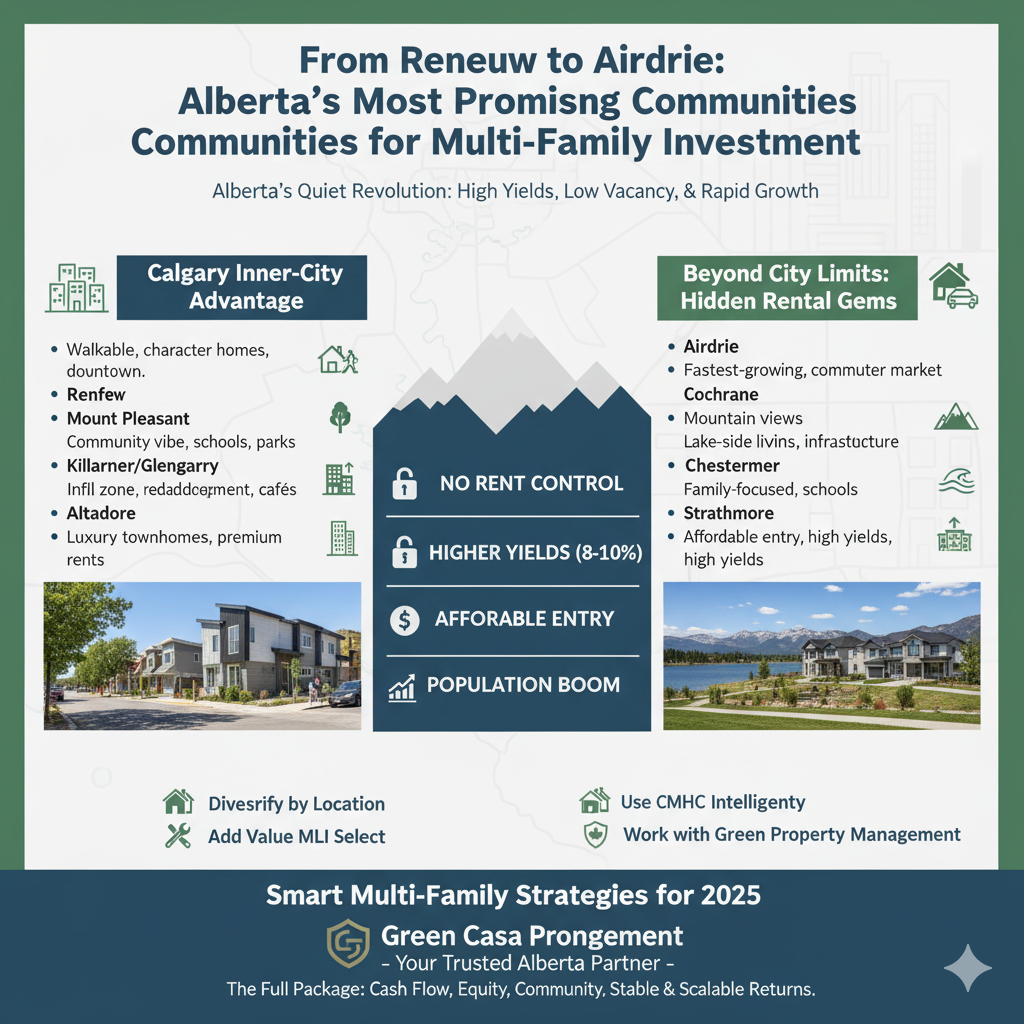

3. The Calgary Inner-City Advantage: High Demand Meets Character

Calgary’s inner-city communities are magnets for young renters and professionals who want modern living close to downtown. These neighborhoods offer infill potential, walkability, and long-term value appreciation.

🏘️ Top Inner-City Hotspots:

- Renfrew: Tree-lined streets, character homes, and proximity to downtown. Great for duplexes and 4-plex conversions.

- Mount Pleasant: A community vibe with schools, parks, and accessibility, renters love its balance of calm and convenience.

- Killarney/Glengarry: One of Calgary’s strongest infill zones with consistent redevelopment and rising rental demand.

- Bridgeland: Trendy, walkable, and full of cafés, bike paths, and lifestyle amenities, perfect for boutique rentals.

- Altadore: Known for luxury townhomes and high-income tenants seeking premium finishes and modern layouts.

Investors in these areas enjoy steady rent growth, strong tenant quality, and minimal vacancy risk, especially when partnered with professional management like Green Casa.

4. Beyond City Limits: Alberta’s Hidden Rental Gems

Not all strong returns come from the city core. Surrounding towns near Calgary are thriving, combining affordability, family appeal, and high rental yields.

🌆 Top Towns Around Calgary for Investors:

- Airdrie: One of Alberta’s fastest-growing cities, just 25 minutes from downtown Calgary. Strong commuter rental market and family demand.

- Cochrane: A stunning mountain-view town with modern infrastructure, great for duplex or triplex investments.

- Chestermere: Lake-side living that attracts middle-income tenants wanting more space while staying close to the city.

- Okotoks: Known for community culture and schools, ideal for long-term tenants and growing families.

- Strathmore: An underrated gem offering lower entry costs and above-average rent yields, ideal for newer investors.

Each of these markets offers something unique, lower purchase prices, higher rent-to-value ratios, and untapped growth potential.

5. Smart Multi-Family Strategies for 2025

If you’re thinking about jumping into Alberta’s booming rental market, consider these investor-approved strategies:

- Diversify by Location: Pair an inner-city Calgary asset (for appreciation) with an Airdrie or Cochrane property (for cash flow).

- Add Value Intelligently: Renovate kitchens, update flooring, or add suites to justify higher rents. Value-add projects perform well in Alberta.

- Use CMHC-Insured Loans: Leverage CMHC’s MLI Select program for up to 50-year amortizations and lower interest rates on energy-efficient or affordable units.

- Monitor Migration Patterns: Follow where population growth is headed. Alberta continues to lead Canada in net in-migration.

- Work with a Local Expert: Partner with a management team that understands Alberta’s rental laws, tenant needs, and market timing like Green Casa Property Management.

Conclusion: Alberta’s Moment Is Now

Alberta’s rental market is entering a golden window of opportunity with strong demand, rising yields, and investor-friendly policies.

From the urban charm of Renfrew and Killarney to the growing potential of Airdrie and Cochrane, there’s never been a better time to invest out west.