Introduction

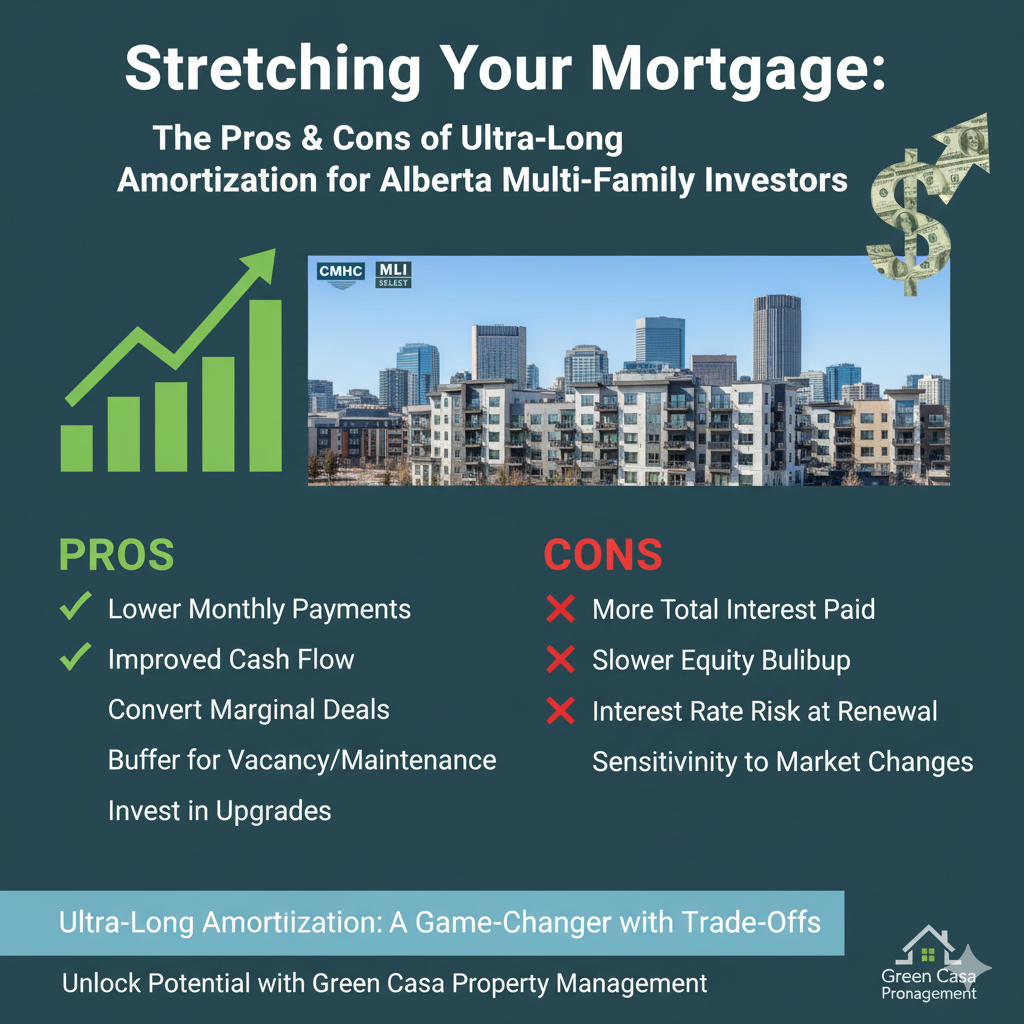

For many investors, one of the biggest hurdles to multi-family real estate is the monthly mortgage payment. What if you could stretch amortization out to 40, 45, or even 50 years and reduce those payments dramatically? That’s possible now for many via MLI Select. This blog explains how, where, and when this makes sense especially for investors buying in inner Calgary or expanding into suburbs and satellite towns.

1. Basics: Amortization vs Term vs Interest Rate

- Term: This is how long your interest rate is fixed (often 5 or 10 years).

- Amortization: This is how long in total you expect to pay off the loan (e.g., 25, 30, 50 years). A longer amortization lowers your payments each month, but extends how long you carry the debt.

With MLI Select, you can combine favorable interest rates, high loan-to-value (LTV), and extended amortization to make multi-family projects more attractive. MLI Select+2New Homes Alberta+2

2. Payment Differences: See It In Action

Suppose you are looking at purchasing a 6-plex in Mount Pleasant or Renfrew for $1,500,000. Interest rate ~ 5%.

- Under a 25-year amortization, your monthly mortgage payment might be $8,500 (just an example).

- Under a 50-year amortization (if approved via MLI Select), that same payment could drop to around $6,200 – saving you $2,300/month or more.

That difference can:

- Convert a marginal deal into a positive cash flow property.

- Allow you to invest in better finishes or tenant experience.

- Provide a buffer for vacancy, maintenance, or unplanned costs.

3. Trade-Offs That Matter

- More total interest paid over the lifetime sometimes significantly more.

- Slower equity buildup; you repay principal more slowly.

- Risk of rising rates at renewal terms. Even if amortization is 50 years, you’ll often need to renew every 5 or 10 years, possibly at higher rates.

- Greater sensitivity to market changes: property values, rent growth, and maintenance inflation all impact margins more over longer time.

4. When Ultra-Long Amortization Makes Sense

Use these rules of thumb:

- If rent growth in your area is reasonably strong and predictable (inner city like Killarney, Kensington, Renfrew, or fast-growing suburbs/towns like Airdrie, Chestermere, Okotoks). Growth helps you raise rents, improve net returns.

- When you have a relatively new build or well-maintained property so maintenance is predictable.

- If your strategy is to hold long term (10+ years), not flipping quickly.

- If you can secure good interest rate terms and manage the risk of future renewals or refinancing.

5. How Green Casa Property Management Helps You Use Ultra-Long Amortization Well

Green Casa can support you in making the most of long amortization mortgages by:

- Running detailed cash flow projections (25-year vs 50-year) so you see the trade-offs clearly.

- Helping select properties in communities that are likely to see rent growth and long-term demand — inner city (Mount Pleasant, Renfrew, Killarney) or suburbs/towns (Airdrie, Chestermere, Okotoks, Strathmore).

- Managing tenant turnover, maintenance, and upgrades to protect income.

- Keeping you compliant with the requirements for MLI Select (energy efficiency, affordability, accessibility) so you qualify for the best terms.

Conclusion

Ultra-long amortization (40-50 years) under programs like CMHC’s MLI Select can be a real game-changer in multi-family real estate investing in Alberta. The lower monthly payments make for better cash flow, reduced financial stress, and allow more flexibility. But it isn’t a free lunch; there are interest costs, equity, and timing trade-offs.

For many investors, especially those ready to hold property for a long time, in communities inside and outside Calgary, this tool makes possible deals that would otherwise feel out of reach. With Green Casa by your side, you can navigate the numbers, pick the right properties, and manage them for maximum return.