Introduction

In 2025, real-estate investors looking at the Calgary region are finding that the best strategy often isn’t “buy anywhere and hope” but rather a tiered approach: (1) inner-city neighborhoods with established rental demand and redevelopment/infill upside, and (2) nearby commuter towns with growing populations, more affordable entry, and strong yield potential. This blog walks through both sides of that strategy, with detailed profiles, market echoes, and investor takeaways.

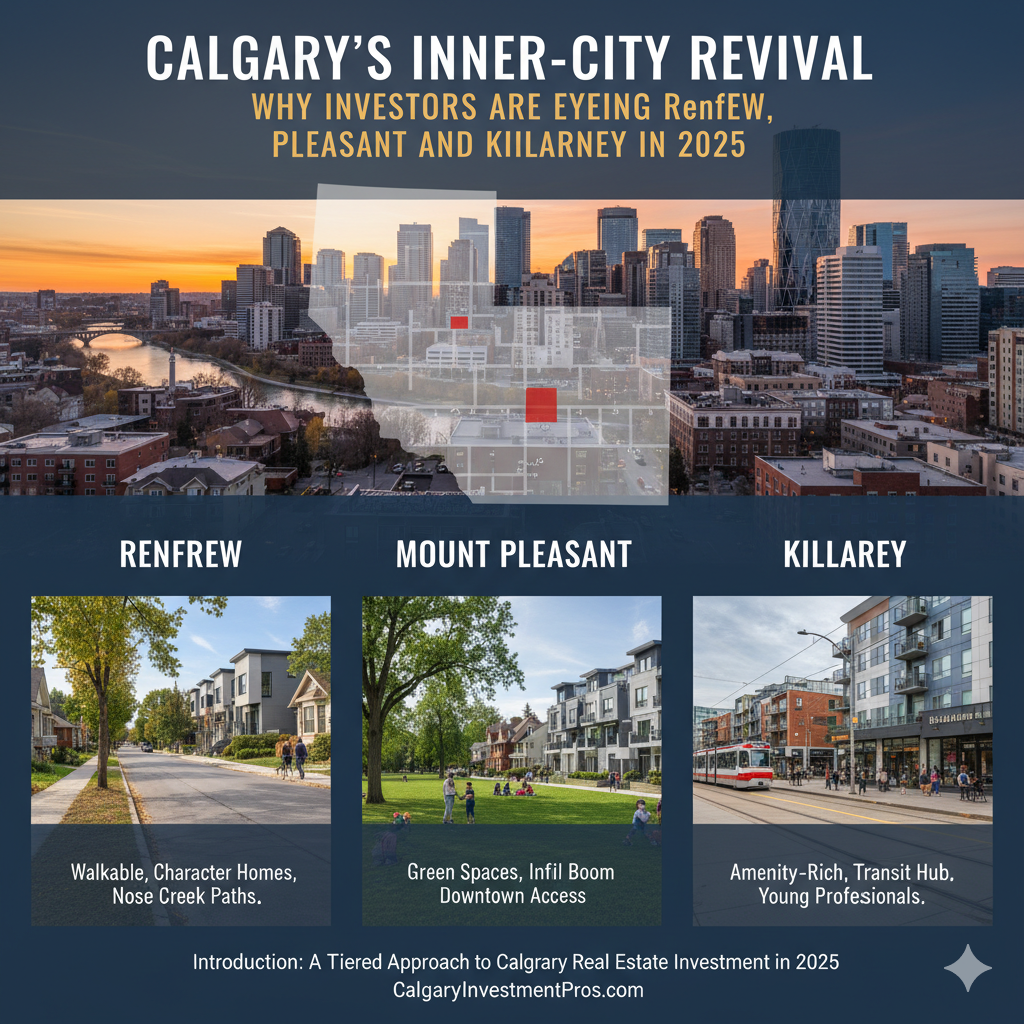

Inner-City Neighbourhoods

Renfrew

Profile & Vibe

Renfrew is one of Calgary’s inner-city gems. Located in the NE quadrant, it is bounded by Edmonton Trail to the west, Nose Creek escarpment to the east, the Bow River escarpment to the south, and 16th Avenue NE to the north. heritageinspiresyyc.org+2calgarymap.com+2 Its development accelerated in the 1940s and ’50s after the original airport site was repurposed. heritageinspiresyyc.org+1

With a mix of older bungalows, some infill builds, and a growing café/restaurant scene, Renfrew blends character with convenience. Locals appreciate its walkability, connection to the Nose Creek bike/pedestrian paths, proximity to downtown, and its community feel. teamhripko.ca+1

Demographics & Market Dynamics

- The community profile from the City of Calgary shows that Renfrew has a projected population trend from 2014 to 2042, signifying recognized long-term stability. https://www.calgary.ca+1

- For example, a housing-market summary reported the average sold price around 2023 was ~$519K, with detached making up about 46% of sales, condos ~28%, and townhomes ~20%. home.bode.ca

- Online resident feedback confirms strong location appeal and investment interest: “Overall, I recommend it. … I used to transit downtown; it only took me 10 minutes by bus.” Reddit

Investor Considerations

- Rental demand: close to downtown, good transit access, a mix of unit types makes it favorable for young professionals and small families.

- Infill/renovation opportunity: Older stock means you can buy at a moderate entry cost, renovate suites or upgrade finishes, and benefit from appreciation plus rental income rise.

- Cash flow vs value trade-off: Prices are higher than outer-suburbs, so yield may be lower, but appreciation and capital growth might compensate.

- Risks: Parking/traffic issues (especially near 16th Ave and trucks), noise from major roads/rail. One resident wrote: “If you buy into the newer built three-story units … garage flooded … insufficient drainage” on Reddit

So due diligence on the lot, drainage, and infrastructure is important.

Investor-play “scorecard”

| Criterion | Rating | Notes |

|---|---|---|

| Entry cost | Medium-High | ~$500K+ entry for many homes, though some infill/townhomes lower. |

| Rental demand | Strong | Central, transit, amenities. |

| Upside potential | Good | Infill, renovation, repositioning. |

| Yield (cash flow) | Moderate | Given higher cost base, yields might be tighter. |

| Holding-period viability | Excellent | Good for 5-10+ years hold. |

Strategy: Buy a well-located bungalow or infill build, add a legal suite or modernize it, lock in a steady tenant, and hold for long-term capital growth. Consider a small multi-unit (duplex/side-by-side) if zoning allows.

Mount Pleasant

Profile & Vibe

Mount Pleasant lies north of the Trans-Canada Highway (16th Ave) in Calgary. It features a combination of older homes and newer infill and allows relatively easy access to downtown. Residents enjoy good transit routes and access to green spaces like Confederation Park. teamhripko.ca+1

Investment dynamics

- The area is seeing infill development, which can drive rental inventories and value appreciation.

- The mix of housing types means flexibility: you might pick up a small older house, add a suite or convert it into a duplex, or buy a newer townhome built for rental purposes.

- For investors, the opportunity is to “buy ahead” of the full infill wave, or target properties that need repositioning.

Strategic cautions

- Infill often brings higher construction or renovation costs (permit issues, matching materials, paying premiums).

- Parking and lot size might be constrained compared to suburbs, which could impact rental appeal if families require space.

Suggested approach: Purchase a house in Mt Pleasant, either incorporate a suite or tie in with a small build-to-rent strategy (if zoning allows), hold for 7-10 years for both cash flow growth and capital appreciation.

Killarney/Glengarry (often just “Killarney”)

Profile & Vibe

Killarney (often referred to as Killarney/Glengarry) is a well-known inner-city neighborhood west of downtown Calgary, close to 17th Ave and major amenities. Because its boundaries are central, it has good accessibility to all parts of the city.

Investment angle

- Strong rental demand from students, young professionals, singles, and couples who value proximity, amenities, and transit.

- Older apartments and low-rise multifamily may be ripe for value-add: renovate units, update finishes, improve rents.

- Also good for small multi-unit investment (4-6 units) or stacked townhomes built for investment.

Considerations

Supply risk: Because it is a hot zone, competition may be higher for properties, and newer purpose-built rentals may increase supply so plan for market risk.

As with inner-city core markets, purchase price will be elevated relative to outer suburbs cash-flow yields will be lower unless you find value or structure correctly.

Commuter Towns & Suburbs; Growth Engines

Cochrane

Growth & Stats

Cochrane is one of Alberta’s fastest-growing municipalities:

- The 2024 municipal census indicates a population of 37,011, up ~43% since 2016. Town of Cochrane+1

- The Alberta regional dashboard shows Cochrane’s population in 2024 as ~38,014, up ~4.75% year-over-year and ~22.6% over the last five years. regionaldashboard.alberta.ca

- Reports suggest Cochrane is part of the Calgary CMA, which saw the highest population growth in Canada from July 2023 to July 2024 (~5.8%), with inter-provincial migration being a major driver. cochranenow.com

What does this mean for investment?

- Strong population growth = expanding rental base, especially for families and working commuters.

- Supply side: New homes being built, meaning potential inventory growth, good for investing early in growth communities.

- Better yield: Because entry prices are lower than in inner-city Calgary, yields for rental investments often look more favorable.

- Family-oriented: Expect 3-4 bedroom homes, yard space, good schools, which means you can target higher rents and lower turnover.

Investor Strategy

- Buy single-family houses or multi-units (4-6 units) in newer neighborhoods that are still in development or recently stabilized.

- Consider the life-cycle of a town: as population grows, infrastructure (schools, transit) improves, factor that into the hold horizon.

- Keep operational expenses in check (commuter towns often have different service levels/fees) and ensure lease demand is backed by census trends.

Risks & Mitigation

Commuting premium: If many tenants will commute to Calgary, then transit infrastructure and parking matter, target neighborhoods with good access to highways or transit.

Infrastructure/roads/transit may lag growth → risk of commuting delays or tenant dissatisfaction. (See community commentary: infrastructure catch-up is a challenge). Reddit

Future supply risk: Many units may be built soon; ensure your purchase is either early or differentiated (location within town, build quality).

Strathmore, Okotoks, Chestermere, Airdrie

Instead of writing full, deeper profiles for each, here’s a summary of how each plays into the investment strategy:

- Strathmore: More affordable entry than many Calgary suburbs, with commuter access, great for volume rentals and longer-term holds.

- Okotoks: Strong family appeal, good schools, lifestyle draw. For investors, this means build for 3-4 bedroom rentals or even small townhome projects.

- Chestermere: Lakefront and lifestyle amenities create niche rental demand (families, seasonal renters) plus everyday commuters.

- Airdrie: A Larger commuter city north of Calgary. Because it is larger and more established, you can scale multiple properties in a portfolio here.

Common themes:

- Lower entry cost → higher potential yield.

- Growth tailwinds (population, infrastructure) are favorable.

- Tenant profiles differ: more families, more long-term renters, often less frequent turnover than single professionals in the inner core.

- Holding timeframe might need to be longer (7-15 years) compared to some inner-city flips or infill plays.

Putting It Together: Choose Your Blend

Here’s how an investor can blend these two tiers for optimal portfolio construction:

- Core asset (stability): Pick one or two good inner-city properties (e.g., Renfrew or Killarney) for relatively stable income + appreciation. Accept slightly lower yield, compensate with stronger long-term growth.

- Growth/scale assets: Pick 2-3 properties in outer towns (Cochrane, Strathmore, Airdrie) targeting higher yield and volume. You might buy more units for the same capital, and accept slightly higher operational risk.

- Financing & structure: Assume conservative leverage, ensure local property management, budget for upgrades/renovations (especially in older stock).

- Exit & hold strategy: For inner-city, consider 5-10-year hold; for outer towns, maybe 10-15 years hold, with possible refinance or portfolio sale once town matures further.

Key Metrics to Monitor

- Purchase price per sq ft / per unit vs comparable rentals.

- Current rent levels and vacancy rates in the specific area (town vs city).

- Cap rate and cash-on-cash yield (after expenses).

- Growth forecasts: population growth, infrastructure build-out, transit improvements.

- Renovation/upgrade cost estimates (especially in infill older stock) vs potential value-add.

- Risk of oversupply (especially in commuter towns where many new homes are built).

- Tenant profile and likely turnover/maintenance costs.

Final Thoughts

The Calgary region, when viewed with a layered investment strategy, offers excellent opportunities: inner-city for stability and appreciation, outer towns for scale and yield. By combining the two and by aligning property type to tenant profile and financing to your strategy, you can build a diversified rental/investment portfolio.

If you like, I can insert neighborhood tables (with recent average price, rent, yield estimates) for each of the 6-7 markets above (Renfrew, Mt Pleasant, Killarney + Cochrane, Strathmore, Okotoks, Airdrie) to sharpen the investment comparison.