A Strategic Financing Program for Multi-Family Investors in Canada

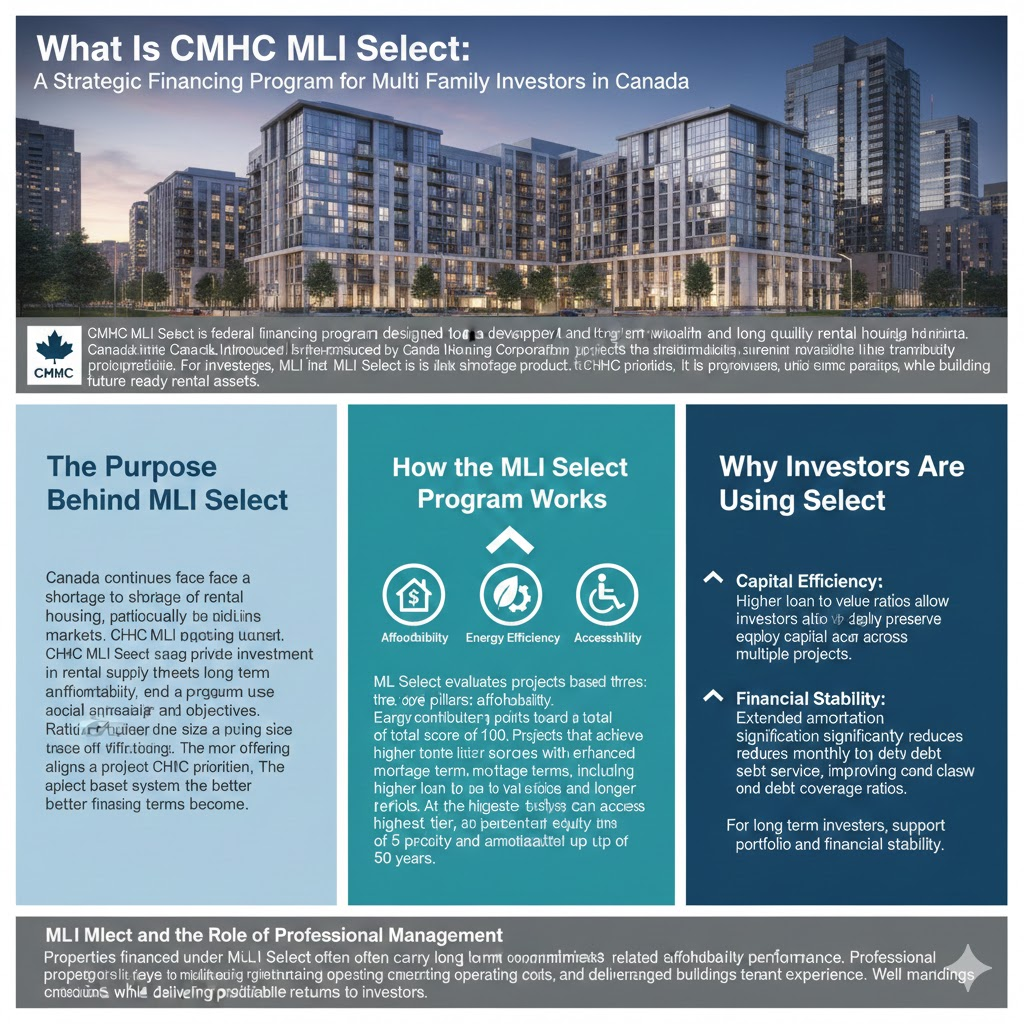

CMHC MLI Select is a federal financing program designed to support the development and long-term ownership of high-quality multi-family rental housing across Canada. Introduced by Canada Mortgage and Housing Corporation, the program rewards projects that contribute to affordability, environmental sustainability, and accessibility.

For investors and developers, MLI Select is more than just a mortgage product. It is a framework that allows owners to unlock superior financing terms while building future-ready rental assets.

The Purpose Behind MLI Select

Canada continues to face a shortage of rental housing, particularly in growing urban markets. CMHC MLI Select was created to encourage private investment in rental supply that meets long-term social and environmental objectives.

Rather than offering one-size-fits-all financing, the program uses a points-based system. The more a project aligns with CMHC priorities, the better the financing terms become.

How the MLI Select Program Works

MLI Select evaluates projects based on three core pillars: affordability, energy efficiency, and accessibility. Each pillar contributes points toward a total score of up to 100.

Projects that achieve higher scores are rewarded with enhanced mortgage terms, including higher loan-to-value ratios and longer amortization periods. At the highest tier, investors can access financing with as little as 5 percent equity and amortizations of up to 50 years.

Why Investors Are Using MLI Select

The primary advantage of MLI Select is capital efficiency. Higher loan-to-value ratios allow investors to preserve equity and deploy capital across multiple projects rather than tying it up in a single asset.

Extended amortization significantly reduces monthly debt service, improving cash flow and debt coverage ratios. This makes projects more resilient to interest rate changes and market fluctuations.

For long-term investors, these benefits support portfolio scalability and financial stability.

MLI Select and the Role of Professional Management

Properties financed under MLI Select often carry long-term commitments related to affordability and performance. Professional property management plays a crucial role in ensuring compliance, managing operating expenses, and delivering a consistent tenant experience.

Well-managed buildings are more likely to meet CMHC expectations while delivering predictable returns to investors.