If you’ve ever dreamed of owning an apartment building but weren’t sure where to start, this is your roadmap. Edmonton is emerging as a multi-family hotspot with affordable entry points, a growing population, and higher yields than many Eastern cities. In this blog, we’ll show you how to evaluate a 10-unit property and make sense of the numbers.

What You’re Looking At

A 10-unit walk-up in south-central Edmonton. Listed at $1,050,000, with all units currently occupied.

- Average Rent per Unit: $1,200/month

- Monthly Gross Income: 10 x $1,200 = $12,000

- Annual Gross Income: $144,000

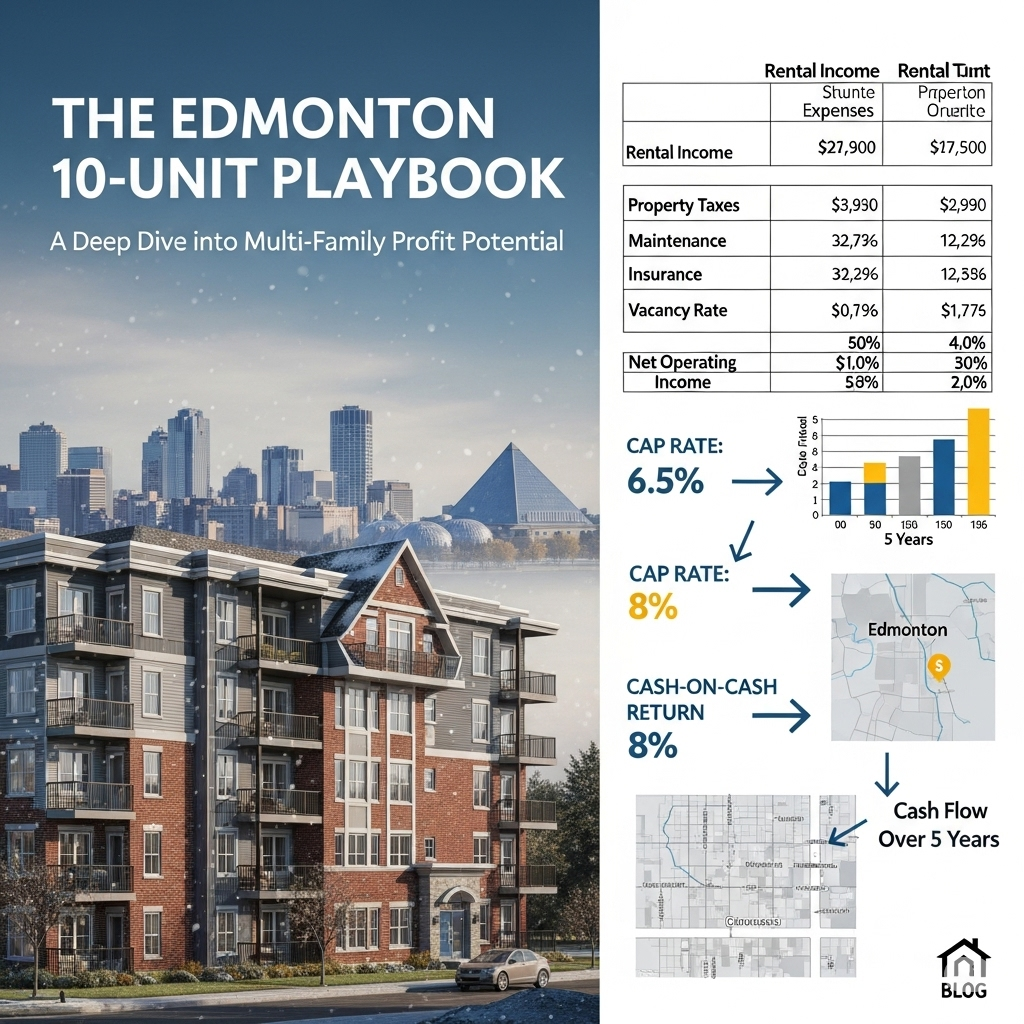

Pro Forma Snapshot

Here’s how to build a simple pro forma.

Annual Income:

✔ Rental Revenue: $144,000

Annual Expenses Estimate:

✔ Property Tax: $17,000

✔ Insurance: $5,000

✔ Utilities: $10,000

✔ Maintenance/Repairs: $8,000

✔ Management (8%): $11,520

✔ Admin/Other: $3,000

✔ Total Expenses: $54,520

📌 Net Operating Income (NOI): $144,000 – $54,520 = $89,480

Investment Metrics That Matter

- Cap Rate = $89,480 / $1,050,000 = ~8.5%

- GRM (Gross Rent Multiplier) = $1,050,000 / $144,000 = ~7.3

- Both metrics suggest a solid investment.

Why Edmonton Wins

Unlike cities like Toronto, Edmonton has:

- No rent control: Allowing annual rent increases to match market demand

- Lower property taxes and utility costs

- Units available under $110,000 per door

- An investor-friendly business climate

Financing This Property

Using CMHC-insured financing (like MLI Select), you could put down just 15% and stretch amortization to 40 or even 50 years, slashing your mortgage payments and maximizing cash flow.

Even a conventional loan with 25% down gives you positive cash flow due to Edmonton’s strong rental spreads.

Conclusion: Know the Numbers, Win the Deal

Understanding financial performance is the key to building real wealth in real estate. Edmonton’s multi-family sector offers a rare combo: affordability, cash flow, and appreciation upside. With a well-managed property and a strong team behind you, like Green Casa, you’re set up to scale.