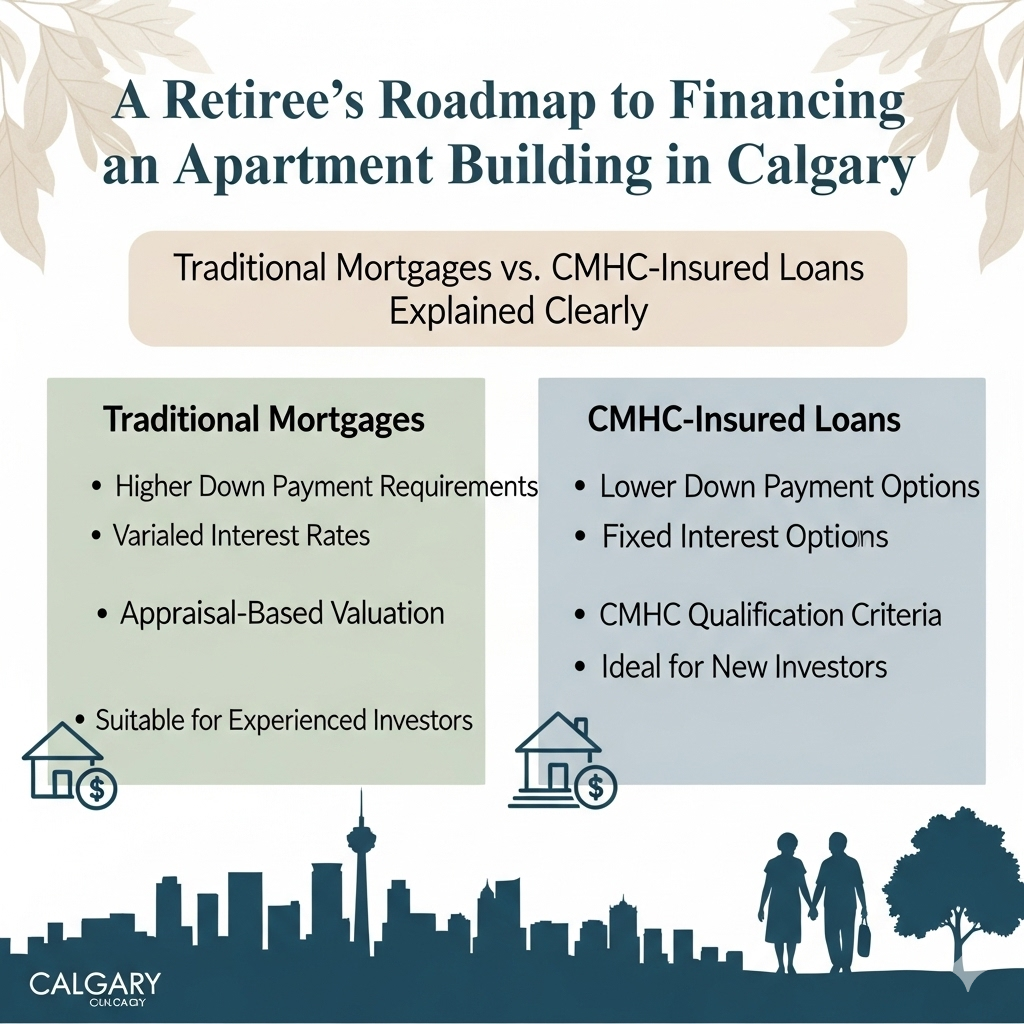

Traditional Mortgages vs. CMHC-Insured Loans Explained Clearly

Introduction

For many Calgarians approaching retirement, the idea of living solely on pensions, RRSPs, or government benefits feels uncertain. Costs of living are rising, medical expenses are unpredictable, and savings sometimes don’t stretch as far as expected. That’s why more and more seniors are exploring apartment building investments, not only as a way to earn a steady income but also as a chance to leave something meaningful for their family.

But how does a retiree actually finance such a purchase? While the thought of taking on a mortgage later in life may sound intimidating, two main financing paths, traditional commercial mortgages and CMHC-insured loans (MLI Select), can make this dream very achievable.

Understanding Traditional Commercial Mortgages

Traditional commercial loans are what many older investors are already familiar with from owning homes or businesses.

- Down Payment: Usually requires 25–30% upfront. On a $2.5 million, 12-unit apartment, that’s $625,000–$750,000.

- Loan Term & Amortization: Typically 20–25 years, which means the monthly payments are higher compared to CMHC options.

- Approval Process: Focuses on both the investor’s financial strength (income, credit history) and the building’s income potential.

- Flexibility: Works for many property types, including those that may not meet CMHC’s energy-efficiency or accessibility criteria.

✅ Best for retirees who have built up substantial savings or equity, want quicker approvals, and prefer straightforward deals, even if the monthly payments are steeper.

Understanding CMHC-Insured Financing (MLI Select)

The Canada Mortgage and Housing Corporation’s (CMHC) MLI Select program was designed to make rental housing more accessible. For seniors entering real estate investing, it offers unique advantages:

- Down Payment: As low as 5–15%, meaning you don’t need to tie up most of your retirement nest egg.

- Amortization: Can extend up to 50 years, drastically lowering monthly payments and improving cash flow.

- Lower Interest Rates: Since CMHC guarantees the loan, lenders offer more favorable terms.

- Qualifying Properties: Buildings with features like energy efficiency or accessibility score higher, but standard apartments can also qualify.

✅ Best for retirees who want peace of mind, stronger monthly cash flow, and the ability to preserve their capital for healthcare, travel, or family support.

Key Considerations for Seniors

- Cash Flow Matters Most: At retirement, a property that pays you every month is far more valuable than one that looks good on paper but drains your savings.

- Risk Comfort: Traditional loans can feel riskier because of high upfront costs, while CMHC-insured loans spread risk and make financing easier.

- Timeline: CMHC loans can take longer to process, so patience is key.

Conclusion

Whether you choose a traditional mortgage for speed and simplicity or a CMHC loan for lower stress and higher cash flow, apartment investing in Calgary can be a retirement-friendly way to secure a steady income. With Calgary’s strong rental demand and population growth, retirees are well-positioned to use financing as a tool to create stability, independence, and a legacy for years to come.