CMHC MLI Select is one of the most impactful financing programs available to multi-family property owners and real estate investors in Canada. Designed to encourage responsible development, affordability, and sustainability, this program rewards investors who build or operate high-quality rental housing with access to stronger financing terms.

For owners looking to grow portfolios without tying up excessive capital, MLI Select can be a game-changer.

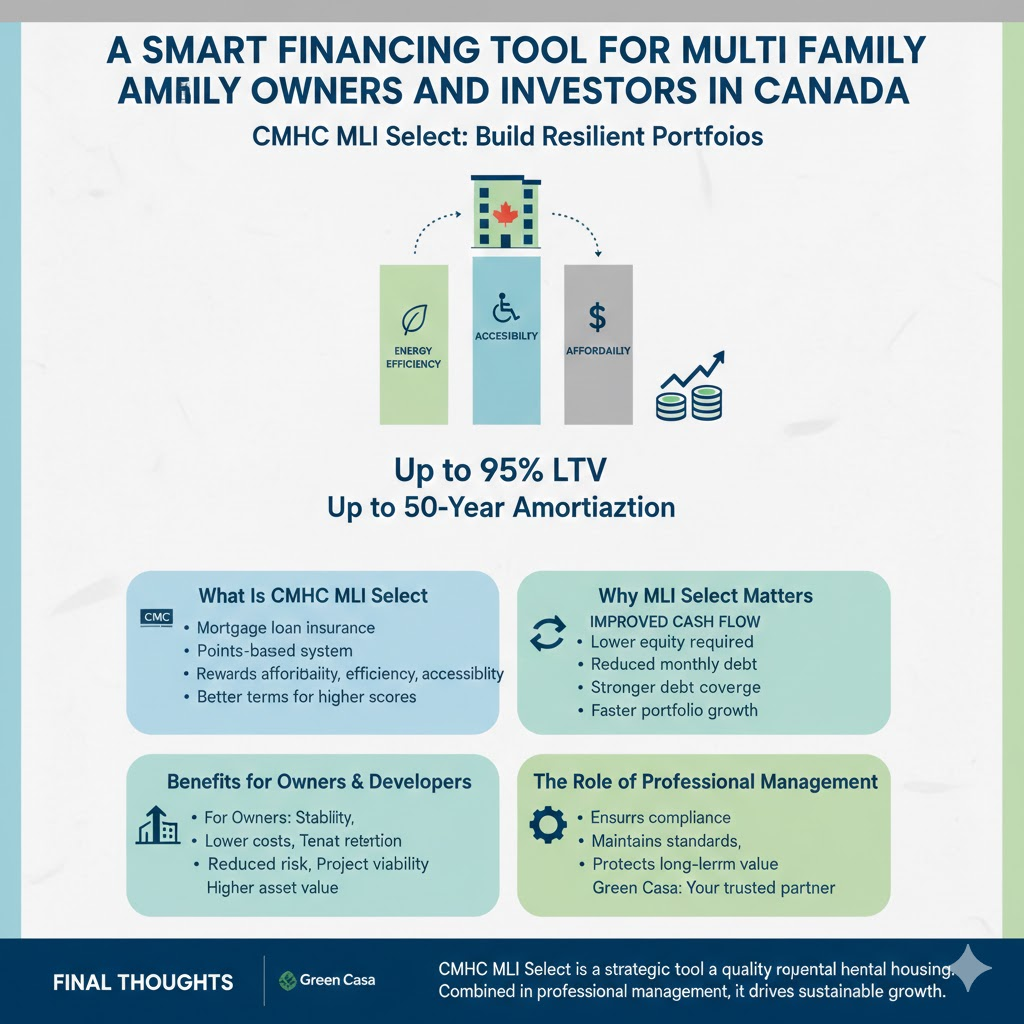

What Is CMHC MLI Select

CMHC MLI Select is a mortgage loan insurance program specifically for multi-family residential properties. This includes apartment buildings, mixed-use residential projects, and purpose-built rental developments.

Unlike traditional financing, MLI Select uses a points-based system. Projects earn points by meeting criteria related to affordability, energy efficiency, and accessibility. The higher the score, the better the financing benefits.

At the highest tier, projects can qualify for up to 95 percent loan-to-value and amortizations of up to 50 years.

How the Points System Works

The MLI Select system is structured around three main pillars.

Affordability rewards projects that offer below-market rents or long-term rental stability.

Energy efficiency encourages sustainable building practices and lower operating costs.

Accessibility supports inclusive design for residents with diverse needs.

Each pillar contributes points. A project that reaches higher point thresholds unlocks improved loan terms, reduced premiums, and longer amortizations.

This structure aligns investor returns with broader housing goals.

Why MLI Select Matters for Investors

MLI Select significantly improves cash flow. Higher loan-to-value ratios reduce the amount of equity required upfront. Longer amortizations lower the monthly debt service. Together, these factors create stronger debt coverage and more predictable returns.

Investors can preserve capital for future acquisitions while still maintaining high-quality assets. In growing markets like Alberta, this flexibility allows investors to scale faster without overleveraging.

The program also supports refinancing existing properties, making it a powerful tool for repositioning or expanding mature portfolios.

Benefits for Owners and Developers

For owners, MLI Select supports long-term stability. Buildings designed with energy efficiency and accessibility in mind often experience lower operating costs and stronger tenant retention.

For developers, the program reduces financial risk during construction and lease-up. Favorable financing terms improve project viability and attract institutional partners.

In both cases, MLI Select supports higher asset value over time.

The Role of Professional Management

To fully benefit from MLI Select, properties must be well managed. Compliance with affordability commitments, maintenance standards, and reporting requirements is critical.

Experienced property management ensures operational discipline, tenant satisfaction, and long-term eligibility under CMHC guidelines.

Final Thoughts

CMHC MLI Select is not just a financing product. It is a strategic tool that rewards thoughtful ownership and long-term investment planning.

For owners and investors committed to quality rental housing, MLI Select offers a clear path to better financing, stronger cash flow, and sustainable portfolio growth.