Introduction

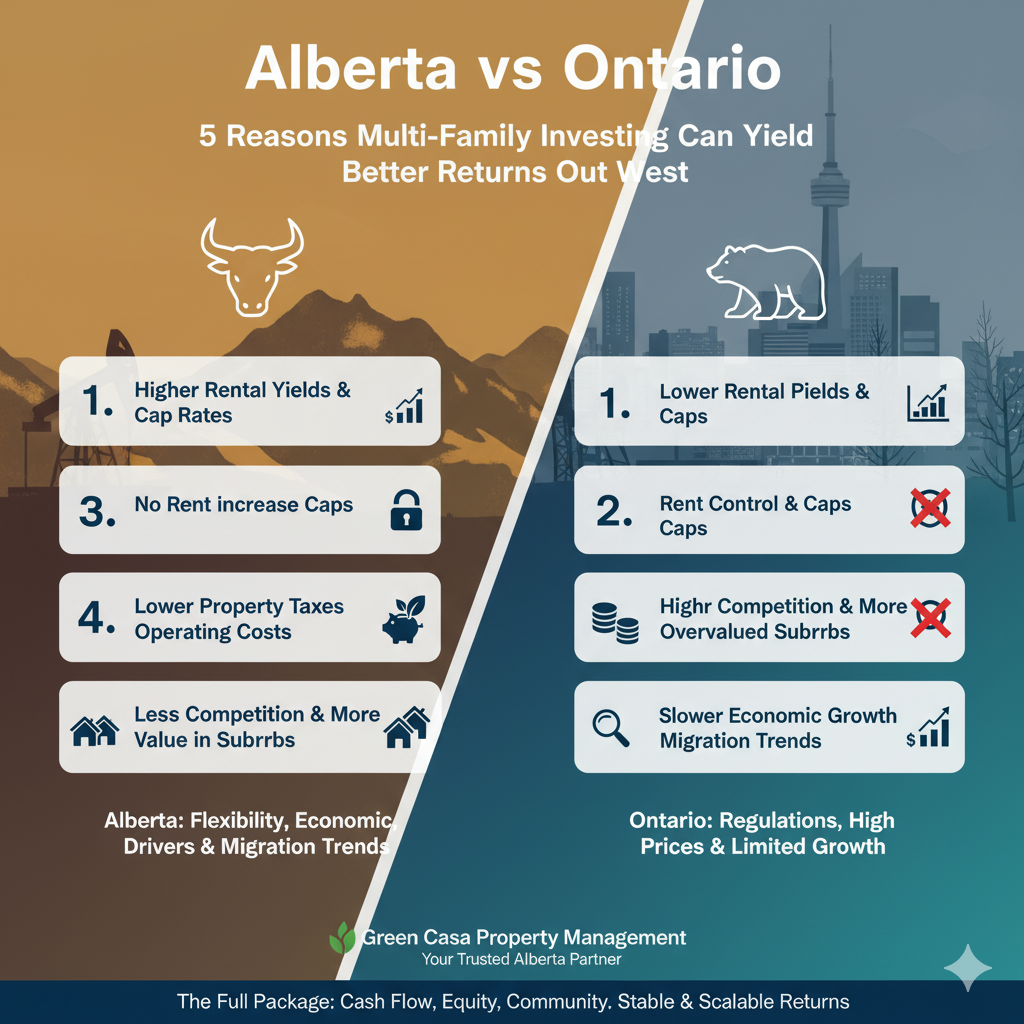

These days, real estate investors from across Canada often ask: Where can I get the best return for my money? While Ontario’s big cities like Toronto and Ottawa get lots of buzz, Alberta, especially Calgary and its surrounding towns, can offer higher returns and less red tape. If you’re considering multi-family investment properties, here are five reasons why Alberta may give you more bang for your buck.

1. Higher Rental Yields and Cap Rates in Alberta

- According to recent data, average gross rental yields (annual rent divided by purchase price) in Calgary are often higher than in many Ontario markets. For certain types of units, Calgary sees yields in the ≈ 6-7%+ range, especially for 1- or 2-bed units. agentleads.ca+3Global Property Guide+3Global Property Guide+3

- After accounting for taxes, maintenance, vacancy, and management, net yields are lower—but even then Alberta’s lower operating costs tend to help preserve higher net returns. agentleads.ca+1

2. No Rent Increase Caps in Alberta

- Unlike Ontario, where there is rent control on many units (particularly older ones, or those built before certain dates) that limits how much a landlord can increase rent each year, Alberta has no provincial rent control. Landlords may raise rents more freely, especially when a lease term ends, provided notice is given. moneygg.com+2thecanadianarab.com+2

- This gives investors more flexibility to respond to market rents, inflation, and rising costs. In Ontario, rent increases are often governed by the Residential Tenancies Act and subject to annual caps (for many units). Wikipedia+1

3. Lower Property Taxes & Operating Costs

- In many Alberta municipalities (especially outside Toronto’s GTHA or Ottawa), property taxes and utility/maintenance costs can be lower, reducing the expense side of owning rental or multi‐family properties.

- Also, development and permitting can sometimes be more streamlined in Alberta towns and suburbs, reducing holding costs and delays.

4. Less Competition & More Value for Growth-Potential Suburbs

- In Ontario, prime multi-family properties are often highly competed over, which pushes up purchase prices and squeezes margins. Alberta’s market has areas with strong demand but lower entry prices, especially in suburbs or towns outside major cores.

- Towns around Calgary, such as Airdrie, Okotoks, Chestermere, Strathmore, and Cochrane, offer this scenario: access to city employment, infrastructure growth, but with a lower purchase price per square foot. These areas are often underpriced compared to similar Ontario suburbs.

5. Pro-Business, Economic Drivers & Migration Trends

- Alberta’s economy is more tied to energy, resources, and increasingly tech, which can lead to economic cycles, but also periods of strong growth and inward migration.

- There has also been migration from Ontario to Alberta (people seeking a lower cost of living, more affordability), which can boost rental demand in Alberta suburbs.

- This migration helps keep vacancy rates reasonable and supports rental demand in areas outside Calgary proper.

Case Examples: Inner City Calgary vs Suburban / Town Investments

Here are some inner city Calgary communities and how they compare vs. towns outside Calgary, for multi-family or small-scale multi-unit investing:

| Community | Strengths | Challenges / Considerations |

|---|---|---|

| Killarney-Glengarry (inner SW Calgary) | Mature inner-city community; good mix of housing stock (bungalows, laned homes, low-rise condos); good transit plans (like LRT extension) which tend to boost value. www.canadianrealestatemagazine.ca | Higher purchase cost; less land available; lot more competition; higher maintenance costs for older buildings. |

| Mount Pleasant | Strong name recognition; established infrastructure; stable demand; desirable for renters who want inner-city, walkability. calgaryhomesearch.ca+1 | Prices are high; less upside in appreciation unless there’s redevelopment; sometimes limited options for multi-unit redevelopment. |

| Renfrew | Close to downtown; good walk-score / amenity access; mix of older homes and new infill, which can enable adding value via renovations or infill builds. marniecampbell.ca+1 | Older building stock might mean higher maintenance; zoning or lot constraints; competition from infill projects pushing prices. |

| Towns like Airdrie, Okotoks, Strathmore, Chestermere, Cochrane | Lower entry cost; growing infrastructure; rising demand as people look to move farther out with better affordability; often new builds with more modern systems (lower maintenance). | Commute times; dependence on infrastructure (roads, transit) continuing to improve; slower appreciation vs inner-city in some cases; sometimes lower rent per square foot, so need scale or unit mix to make margins. |

Conclusion

Suppose you’re comparing Alberta vs Ontario for multi-family investing. In that case, the scale tends to shift in Alberta’s favor for many investors, especially those seeking flexibility, higher yields, and greater growth potential in undervalued markets. Calgary’s inner city communities (like Killarney, Renfrew, Mt Pleasant) offer prestige, stability, and capital appreciation. The towns just outside the city (Airdrie, Chestermere, Okotoks, Strathmore, Cochrane) give affordability, scale, and often newer properties with lower maintenance requirements.