Alberta is stepping into a new era of real estate growth. The province continues to attract new residents, workers, and businesses who are searching for affordability, opportunity, and long-term stability. This demand is driving two major investment categories: commercial properties and multifamily housing. With CMHC’s MLI Select program, investors now have more financing power than ever before to build and scale.

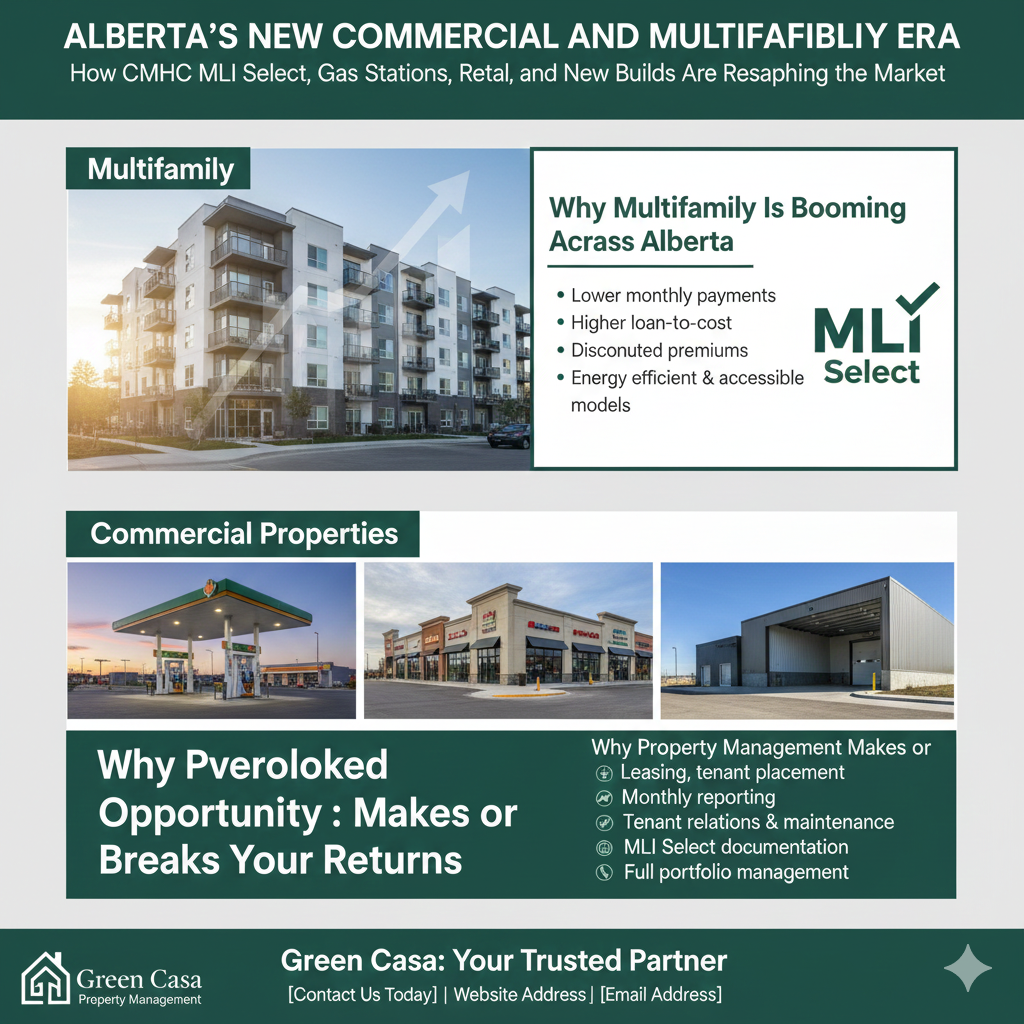

Why Multifamily Is Booming Across Alberta

Cities like Calgary, Edmonton, Airdrie, Cochrane, Chestermere, and Okotoks are experiencing rapid population growth. Rental markets are tightening, vacancy is shrinking, and demand for purpose-built rentals is at a historic high. Investors who enter now secure long-term income, predictable occupancy, and rising property values.

MLI Select is the ultimate tool for multifamily investors because it offers

Lower monthly payments through extended amortization

Higher loan-to-cost and loan-to-value ratios

Discounted premiums and insurance fees

Support for energy-efficient and accessible building models

For developers building thirty to one hundred unit rentals, this financing reduces upfront capital and increases long-term stability.

The Overlooked Opportunity: Commercial Properties

While multifamily is booming, Alberta’s commercial sector is experiencing its own renaissance. Retail bays, commercial plazas, gas stations, drive-thru restaurants, industrial condos, and office spaces continue to outperform expectations, especially in high-demand communities.

Gas Stations and Automotive Service Models

Fuel stations remain one of the strongest cash-flowing commercial assets. Alberta’s highway network, industrial transportation hubs, and rural municipalities guarantee consistent traffic. Investors who choose well-located parcels enjoy long-term corporate leases and predictable income.

New Construction of Commercial Bays

Developers are increasingly building modern multi-bay commercial centers. These bays appeal to

Medical clinics

Trades businesses

Retail shops

Food services

Professional offices

The leasing market moves quickly because growing communities always need more service businesses.

Industrial and Distribution Properties

Industrial continues to be Alberta’s strongest commercial category. Proximity to the Shepard Industrial Foothills Industrial Estate and surrounding logistics corridors makes new industrial builds a winning investment.

Why Property Management Makes or Breaks Your Returns

Commercial tenants have high expectations and strict operational needs. Multifamily buildings require constant oversight, communication, maintenance, and compliance. Without experienced management, investors face vacancy rent loss, unexpected repairs, and poor financial tracking.

Green Casa provides owners with

Leasing tenant placement and negotiations

Monthly reporting and bookkeeping

CAM reconciliation for commercial properties

Tenant relations and maintenance oversight

Support for MLI Select documentation

Full management of multifamily and commercial portfolios

Conclusion

The future of Alberta real estate belongs to investors who understand the strength of multifunctional portfolios gas stations, commercial bays, distribution warehouses, and MLI Select-powered multifamily developments. With a growing economy, a strong business market, and unmatched affordability, Alberta will continue to lead Canada’s investment landscape. With Green Casa managing daily operations, investors gain confidence, stability, and long-term success across every asset type.