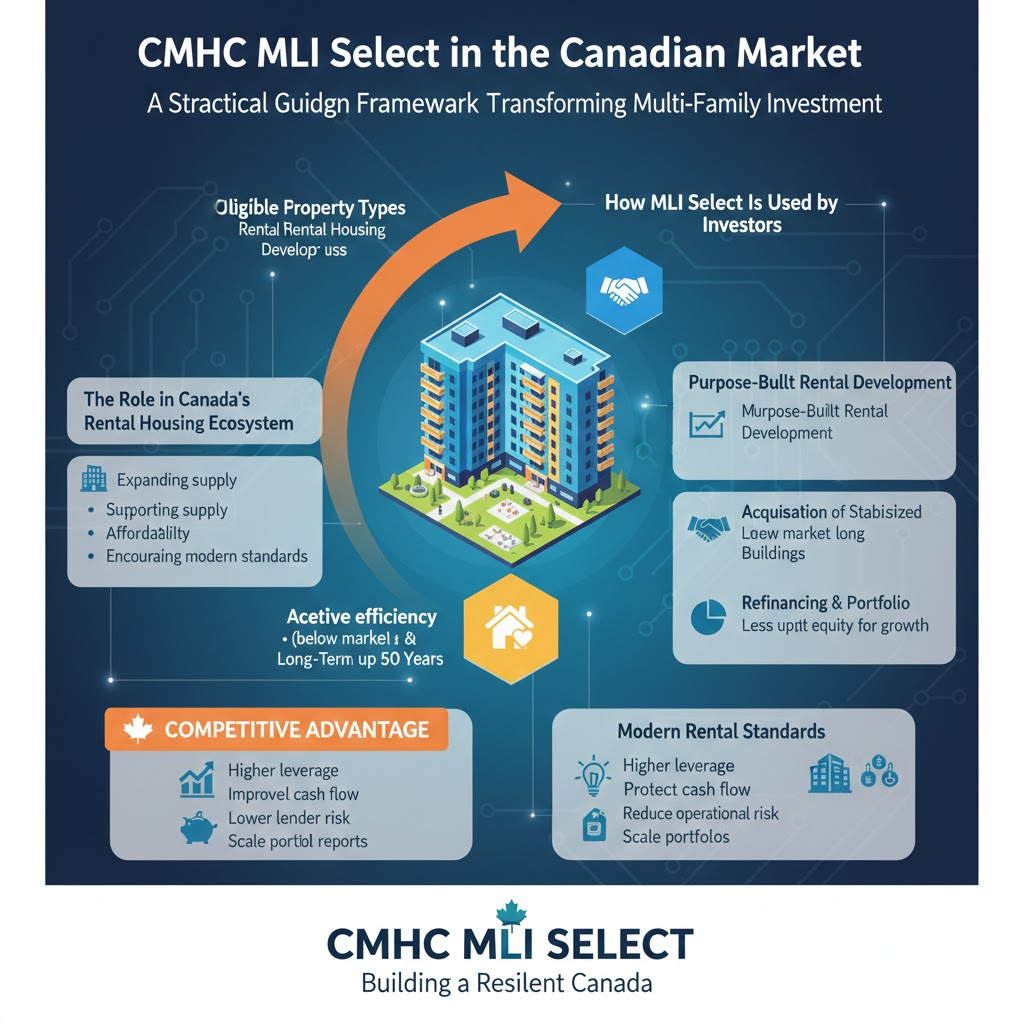

A Strategic Financing Framework Transforming Multi-Family Investment

CMHC MLI Select has become one of the most influential financing programs in Canada’s purpose-built rental housing sector. As housing demand rises, construction costs increase, and rental supply remains constrained in many regions, investors are seeking financing structures that support both long-term stability and scalable growth.

MLI Select is not simply a mortgage insurance product. It is a strategic framework that rewards rental housing providers who align their projects with Canada’s national priorities, including affordability, environmental performance, and accessibility.

In doing so, it has reshaped how multi-family real estate is financed, developed, acquired, and managed across the country.

The Role of MLI Select in Canada’s Rental Housing Ecosystem

The Canadian rental market is undergoing structural change. Population growth, record immigration, and shifting affordability dynamics have accelerated demand for professionally managed rental housing, particularly in urban and high-growth secondary markets.

CMHC introduced MLI Select to encourage long-term rental development by offering enhanced financing terms to owners and developers who contribute to stronger housing outcomes.

In practice, the program serves three critical market functions:

Expanding rental housing supply through improved development feasibility

Supporting affordability through rent-based incentives

Encouraging modern, sustainable building standards

This makes MLI Select a policy-driven financing tool with direct investment implications.

How MLI Select Is Used by Investors and Developers

MLI Select is widely used in the Canadian market across several core transaction types.

Purpose-Built Rental Development

Developers utilize MLI Select to reduce the equity burden required to deliver new apartment buildings. With loan-to-value ratios that can reach up to 95 percent, investors can preserve capital and improve project viability.

Longer amortization periods of up to 50 years further reduce monthly debt service, supporting stronger early-stage cash flow and debt coverage.

Acquisition of Stabilized Apartment Buildings

Investors acquiring existing multi-family assets use MLI Select financing to structure competitive purchases with less upfront equity compared to conventional commercial loans.

This is particularly valuable in markets where pricing remains attractive relative to rental demand, such as Alberta and parts of Atlantic Canada.

Refinancing and Portfolio Recapitalization

Owners of stabilized buildings often refinance through MLI Select to unlock equity for renovations, repositioning strategies, or additional acquisitions.

In this way, the program supports portfolio expansion while maintaining long-term financing stability.

The Competitive Advantage of Enhanced Financing Terms

The practical investment impact of MLI Select is significant.

Higher leverage reduces equity requirements

Extended amortization improves monthly cash flow

CMHC-backed insurance lowers lender risk and often improves borrowing terms

Investors can scale portfolios more efficiently while maintaining operational resilience

For many apartment investors, MLI Select is a foundational tool for achieving sustainable growth without overconcentrating capital in a single asset.

MLI Select as a Driver of Modern Rental Standards

Beyond financing, MLI Select has become a mechanism for improving the quality of Canada’s rental housing stock.

Projects earn points based on measurable commitments to:

Affordable rental structures

Energy efficiency improvements

Accessibility-focused building design

This creates stronger long-term asset performance, reduced operating costs, and improved tenant retention.

Closing Perspective

CMHC MLI Select has evolved into one of the most important structural financing programs in Canada’s multi-family market.

It supports rental supply expansion, improves investor cash flow, and encourages long-term asset quality.

For serious owners and developers, understanding MLI Select is no longer optional. It is a strategic necessity in the modern Canadian rental landscape.