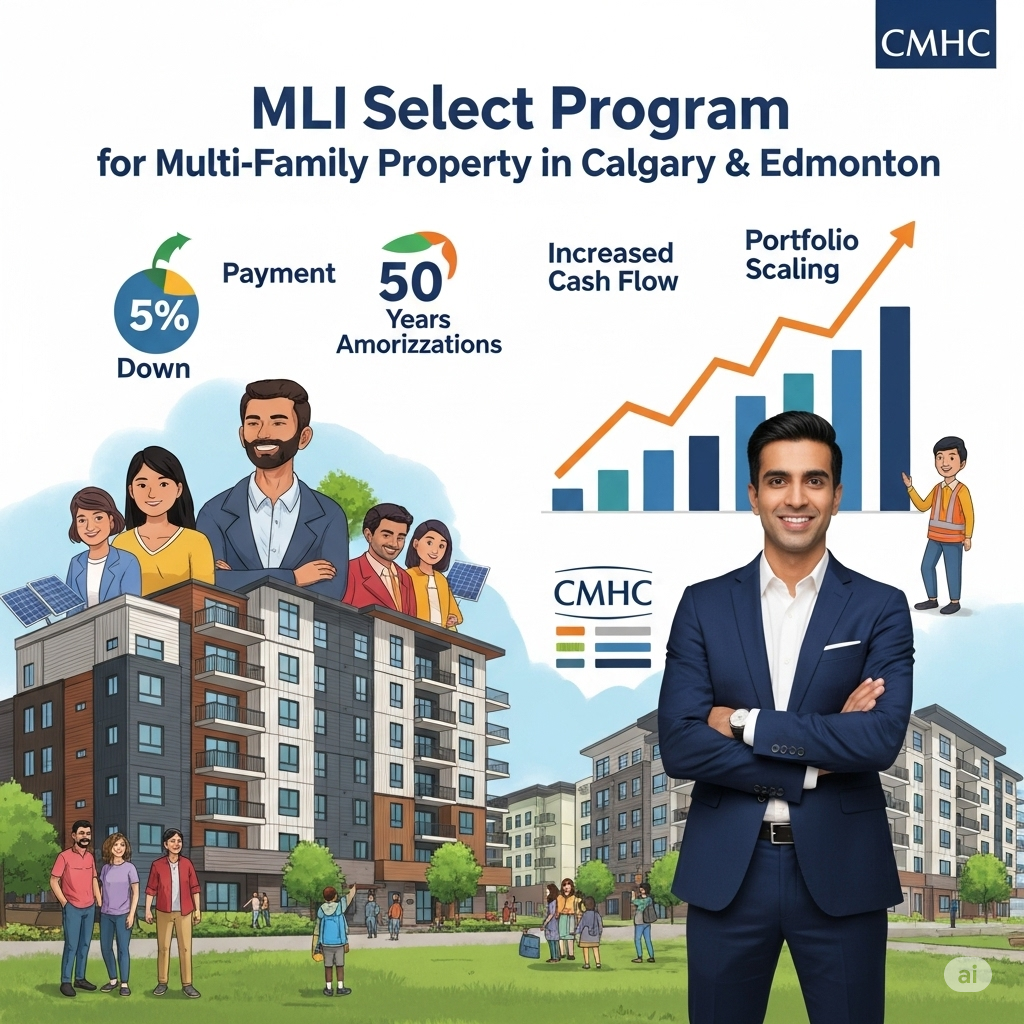

Imagine being able to purchase a 12-unit rental building in Calgary or Edmonton with just 5% down—yes, you read that right—and stretch your mortgage payments out over 50 years.

Sounds too good to be true? That’s what Ahmed thought, too.

Meet Ahmed: The Investor Who Almost Gave Up

Ahmed had been scouring the Calgary market for months, determined to scale beyond his one duplex. But with rising prices, higher interest rates, and lenders asking for 25–35% down on multi-family buildings, his dreams of building generational wealth were starting to feel out of reach.

Then a broker friend told him about something new: CMHC’s MLI Select program—a financing option that’s quietly helping small and mid-sized investors get into apartment buildings with as little as 5% down and amortizations up to 50 years. Suddenly, the math worked. The dream was back on the table.

So, What Exactly is CMHC MLI Select?

The CMHC (Canada Mortgage and Housing Corporation) launched the MLI Select program to encourage the development and long-term ownership of rental housing in Canada. It’s designed for both new construction and existing properties with 5 or more residential units.

Here’s the magic: If your building—and your business plan—checks a few key boxes, you may qualify for up to 95% loan-to-value (LTV) financing, with amortization periods of up to 50 years.

That means:

- Lower down payments

- Lower monthly payments

- Improved cash flow

- And more capital left in your pocket to scale

How Do You Qualify? It’s All About the Points

MLI Select uses a points-based system. The more social impact your rental property has, the better the terms CMHC gives you. There are three main areas where you can earn points:

- Affordability:

Do you offer below-market rents, or will you commit to doing so for a set number of years? - Accessibility:

Does your building include units designed for people with disabilities? - Energy Efficiency:

Are you retrofitting or building with better insulation, windows, or HVAC systems?

To unlock the most attractive terms (95% LTV and 50-year amortization), you need at least 100 points in total, which can come from any mix of those three pillars.

Even partial points (50–99) can qualify you for improved loan terms like 85–90% LTV and 40–45-year amortizations.

Why It Matters: Cash Flow, Scale, and Staying Power

For investors like Ahmed, the benefits go beyond just easier access. Let’s break down why this program is such a big deal, especially in markets like Calgary and Edmonton:

- Cash Flow Friendly:

With longer amortizations, monthly mortgage payments shrink. That means more positive cash flow from Day 1—critical in today’s interest rate environment. - Less Capital Needed:

A 5% down payment on a $2 million building is $100K. Compare that to the $500K needed for a 25% down payment—it’s a night-and-day difference in how fast you can scale. - Stronger in Competitive Markets:

Calgary and Edmonton are seeing strong rental demand, population growth, and investor interest. Having a tool like MLI Select makes your offers more competitive and your business model more sustainable.

But Wait—It’s Not Easy Money

There’s paperwork. There are appraisals. You’ll likely need help from a mortgage broker familiar with CMHC financing. And you’ll have to commit to maintaining the social impact features for at least 10 years (sometimes more). But for the right investor with a long-term mindset? It’s worth it.

Final Thoughts: From Dreamer to Developer

Thanks to MLI Select, Ahmed didn’t just buy one 12-unit building—he’s now working on his second. He’s focusing on energy-efficient retrofits and below-market rents that still generate solid cash flow, thanks to the extended amortization.

The best part? He didn’t need to be a millionaire to get started. Just a strategy, some patience, and the right team.

Are you the next Ahmed?

If you’re thinking about stepping up into multi-family investing in Calgary or Edmonton, the CMHC MLI Select program might just be the key to scaling faster and smarter.

Let’s talk. Or better yet, let’s build something that lasts.