Introduction

In Alberta’s fast-growing real estate landscape, multi-family investing is emerging as one of the best ways to build wealth and a stable income. With no rent control laws, strong population inflows, and consistent job growth, Alberta, especially cities like Calgary and Edmonton, offers fertile ground for investors seeking high-yield rental properties.

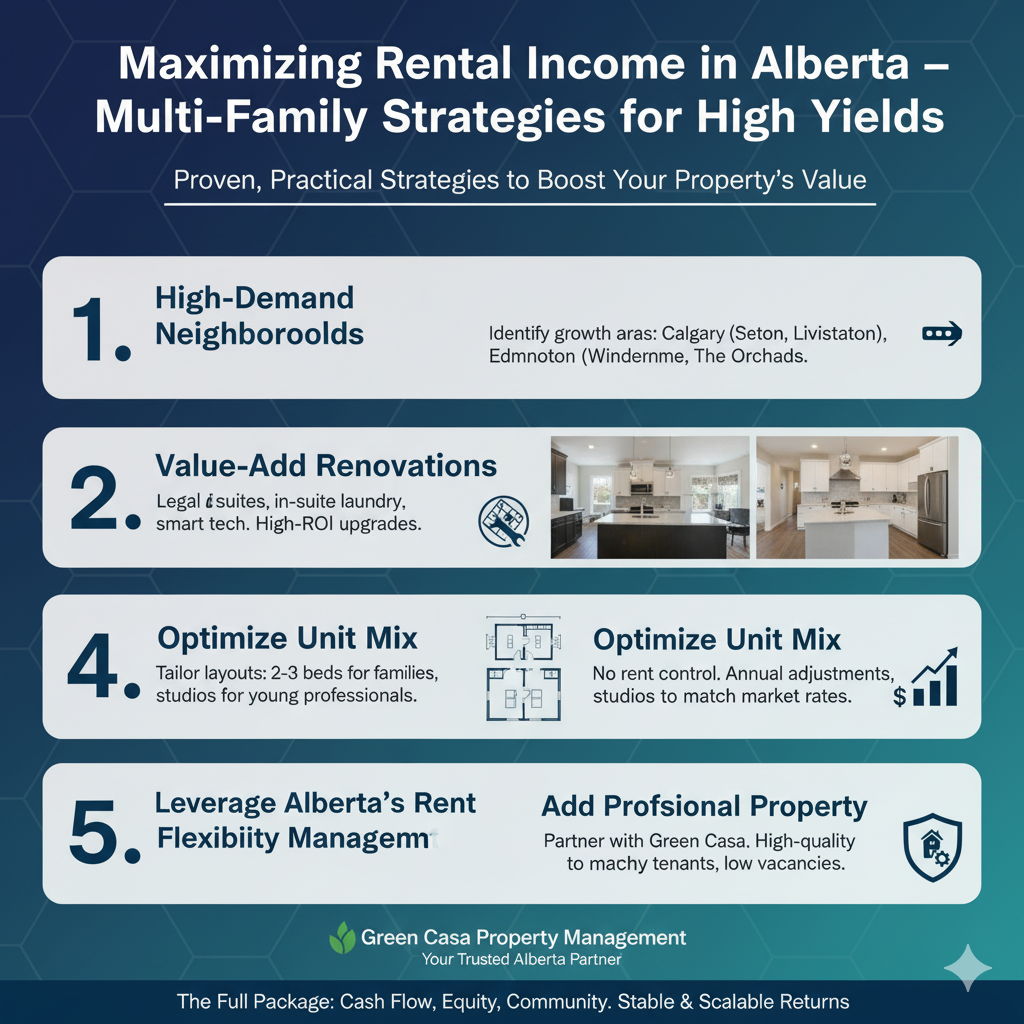

This blog dives into proven, practical strategies to help you boost rental income and maximize your property’s value.

1. Choose High-Demand Neighborhoods Backed by Growth Data

Start with the fundamentals, location. In Calgary, communities such as Seton, Livingston, and Rangeview are booming with new developments, amenities, and schools. In Edmonton, neighborhoods like The Orchards, Windermere, and West Secord show similar momentum.

Why it matters: Areas with strong population growth attract stable tenants and justify rent increases.

Tip: Use municipal growth data or CMHC market reports to identify communities where rental demand is rising faster than supply.

2. Implement Value-Add Renovations

Small upgrades can lead to significant rent bumps. Modern kitchens, in-suite laundry, or energy-efficient appliances make your property stand out in Alberta’s competitive rental market.

Examples of high-ROI upgrades:

- Converting basements into legal suites.

- Adding air conditioning or smart thermostats.

- Installing durable vinyl flooring and quartz countertops.

Tip: Always balance upgrades with expected rent returns. A $10,000 kitchen remodel that boosts monthly rent by $200 pays for itself within a few years.

3. Optimize Unit Mix and Layout

Multi-family investors often overlook the power of the unit mix. By adjusting layouts, adding bedrooms, or creating flexible living spaces, you can attract broader tenant segments.

In Calgary, consider units with 2–3 bedrooms to appeal to families and professionals.

In Edmonton, studio and 1-bedroom units perform well in central areas with high demand from students and young professionals.

Tip: Legalizing secondary suites or garden suites can dramatically lift rental income while diversifying risk.

4. Leverage Alberta’s Rent Flexibility

Unlike Ontario or B.C., Alberta has no rent control, giving investors freedom to adjust rents annually to match market rates.

Strategy: Keep your property well-maintained and review rents every lease renewal. Many landlords underperform simply because they fail to keep up with the market.

Tip: Green Casa Property Management can help you track rental trends and adjust rates strategically to protect tenant relationships while maximizing cash flow.

5. Add Professional Property Management

Managing multi-family assets can get complex. From tenant screening to maintenance coordination, the workload grows quickly.

Solution: Partner with an experienced property management firm like Green Casa, specializing in Alberta’s unique market.

Professional management ensures:

- High-quality tenants.

- Fewer vacancies.

- Regular rent optimization and expense control.

Conclusion

By combining smart location choices, value-add upgrades, optimized layouts, and proactive rent management, Alberta investors can achieve above-average cash flow and long-term equity growth. Whether you’re expanding your portfolio or just starting, the province’s flexibility and growth trajectory make it an ideal market for multi-family success.

Green Casa Property Management is here to help you turn your properties into thriving, income-generating investments that perform year after year.