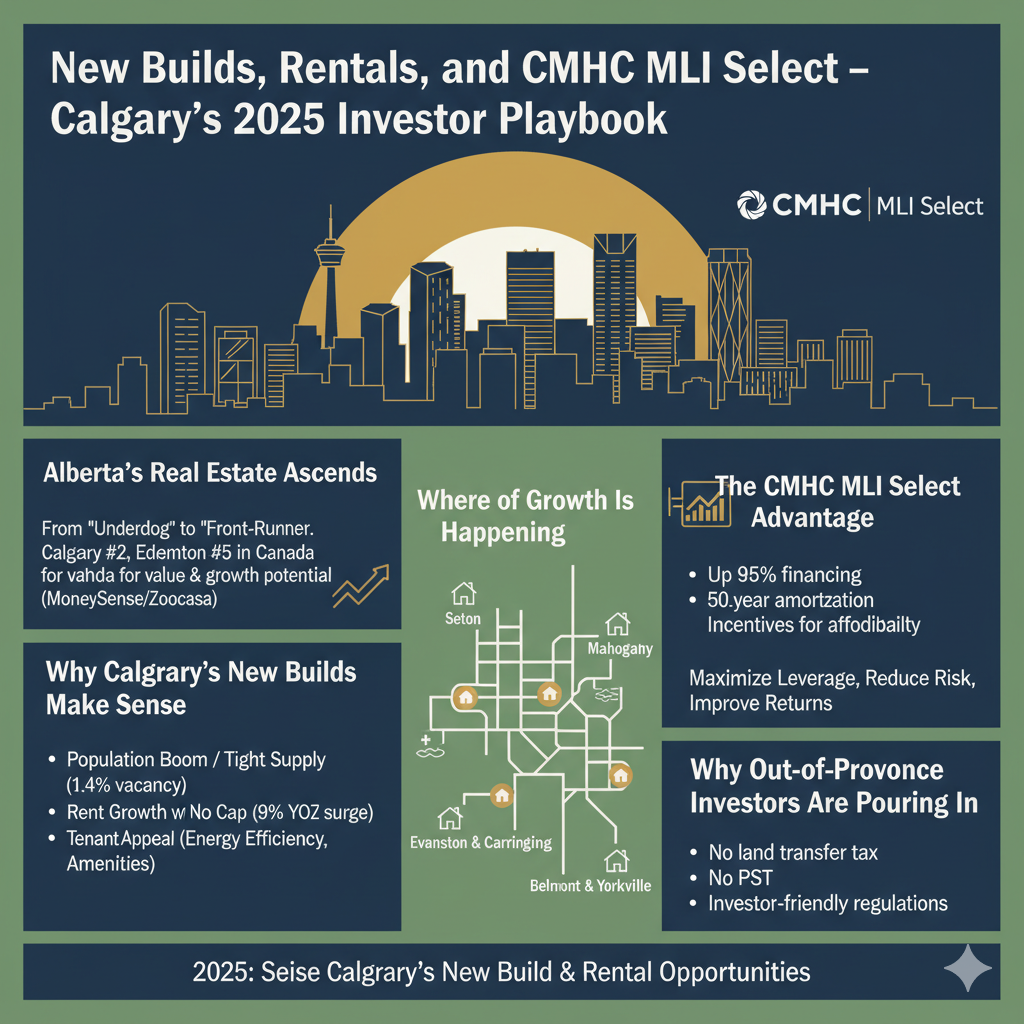

Alberta’s real estate market has moved from “underdog” to “front-runner.” In 2025, MoneySense and Zoocasa ranked Calgary #2 and Edmonton #5 as the best cities in Canada to buy real estate, ahead of Toronto and Vancouver in terms of value and growth potential.

For investors, the key isn’t just buying in, it’s buying smart. And right now, new builds and rental-focused projects in Calgary’s upcoming communities, paired with CMHC MLI Select financing, are offering the strongest returns.

Why Calgary’s New Builds Make Sense

- Population Boom Meets Tight Supply

Alberta’s record migration is straining supply. Calgary’s vacancy rate sits at just 1.4%, and rents surged by 9% year-over-year in 2024. Newcomers often rent first, making brand-new homes with modern finishes especially attractive. - Rent Growth with No Cap

Unlike Ontario or B.C., Alberta has no rent control. Rents are market-driven, allowing landlords to adjust annually. With rents already at 40-year highs, new builds in growing communities present cash-flow opportunities not available in stricter provinces. - Tenant Appeal

New builds come with energy efficiency, better layouts, and desirable amenities, everything tenants want in a competitive market. This reduces vacancy risk and increases rental premiums.

Where the Growth Is Happening

- Seton (Southeast Calgary): With the South Health Campus hospital, major retail, and new schools, Seton is becoming a city within the city.

- Mahogany (Southeast): A master-planned lake community blending lifestyle and rental demand.

- Evanston & Carrington (Northwest): Affordable options for first-time buyers and renters close to employment hubs.

- Belmont & Yorkville (Southwest): New road connections and family-focused developments are fueling demand.

The CMHC MLI Select Advantage for Investors

For those building or buying multi-family properties, CMHC’s MLI Select program is a game-changer:

- Up to 95% financing → less capital needed upfront.

- 50-year amortization → lower monthly costs and higher cash flow.

- Incentives for affordability, accessibility, and sustainability → access to preferred financing terms.

In practice, this means investors can maximize leverage, reduce risk, and improve long-term returns. In a market like Calgary, where rents are rising and vacancy is tight, the combination of new builds with MLI Select financing is especially powerful.

Why Out-of-Province Investors Are Pouring In

Ontario and B.C. investors are discovering Alberta because:

- No land transfer tax (savings of thousands per purchase).

- No PST (lower construction and maintenance costs).

- Investor-friendly regulations (fewer restrictions, faster approvals).

This environment, paired with Calgary’s growth, makes it one of the few markets in Canada where investors can still achieve both cash flow and appreciation.

Final Thoughts

For investors, 2025 is the year to seize Calgary’s new build and rental opportunities. With surging demand, strong rental income potential, and financing advantages like MLI Select, the fundamentals are stacked in Alberta’s favor.