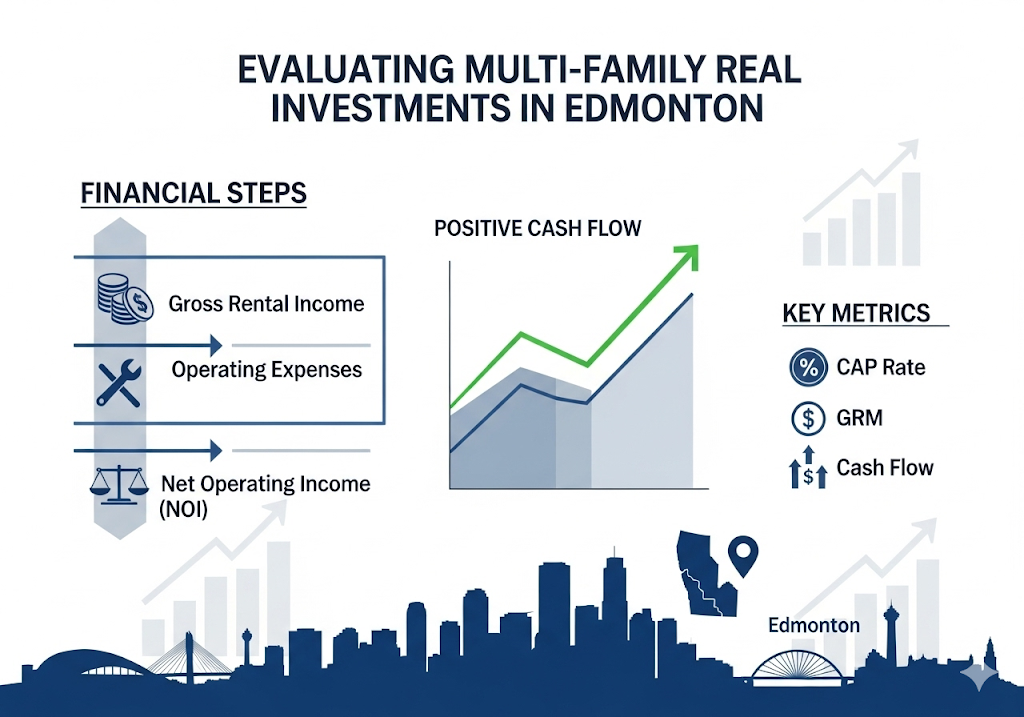

Introduction: Real Estate Investing is a Numbers Game

Many first-time multi-family investors ask the same question: How do I know if a property is a good deal? The truth is, it comes down to a few key metrics. Once you learn how to calculate them, you can quickly separate opportunities from traps.

Let’s walk through an analysis of a 10-unit Edmonton apartment building, using real-world assumptions.

Step 1: Calculate Income

Assume rents are slightly higher in this building, say $1,200/unit (some buildings in central Edmonton can command this).

- Monthly Rent: $1,200 × 10 = $12,000

- Annual Gross Rent: $144,000

Vacancy adjustment (5%): $144,000 – $7,200 = $136,800 effective rental income

Step 2: Budget for Operating Expenses

Here’s a realistic breakdown for Edmonton:

- Property Taxes: $20,000

- Insurance: $7,000

- Utilities (landlord-paid): $12,000

- Maintenance & Repairs: $14,000

- Property Management: $14,000

Total: $67,000

Step 3: NOI (Net Operating Income)

- Effective Rental Income: $136,800

- Expenses: $67,000

= $69,800 NOI

Step 4: Core Investment Metrics

Cap Rate

If the purchase price is $950,000:

Cap Rate = $69,800 ÷ $950,000 = 7.3%

GRM

= $950,000 ÷ $144,000 = 6.6

Cash Flow

Financed with 25% down ($237,500), mortgage $712,500 @ 5%/25 years:

Annual debt service ≈ $50,300

Cash Flow = $69,800 – $50,300 = $19,500 annual profit (~$1,625/month)

Step 5: What These Numbers Mean

- Cap Rate of 7–8%: Shows the deal is generating strong income relative to price.

- GRM under 7: Suggests you’re buying at a favorable price per rent dollar.

- Positive Cash Flow: $1,600/month in passive income, while tenants pay down your mortgage.

Step 6: Edmonton-Specific Advantages

- Lower Cost Per Door: You can still find multi-family under $1M, rare in Canada.

- Resilient Rental Market: Steady demand from students, workers, and newcomers.

- Investor-Friendly Metrics: Double the cap rates of Toronto or Vancouver.

- Balanced Growth: Strong cash flow now + long-term appreciation potential.

Conclusion: A Blueprint for Decision-Making

Evaluating a 10-unit property isn’t about gut feelings; it’s about clarity. With:

- $69,800 NOI

- 7.3% cap rate

- $19,500 cash flow

This Edmonton example proves why disciplined investors are flocking to Alberta’s multi-family market. If you master these calculations, you’ll always know whether to buy, hold, or walk away.