Alberta is changing, and so is the way investors build long-term wealth. From Calgary’s multi-family rental boom to surprising opportunities in gas stations, mixed-use plazas, medical buildings, and commercial condos, the province is becoming an investment powerhouse. But with growth comes complexity, and that’s where smart management becomes an advantage.

At Green Casa Property Management, we see the evolution happening from the inside. Owners are asking smarter questions. Tenants expect better. And financing programs like CMHC’s MLI Select are reshaping how investors build and scale multi-family portfolios.

In this blog, we break down the new Alberta investment environment and how proper management turns these opportunities into stable, predictable returns.

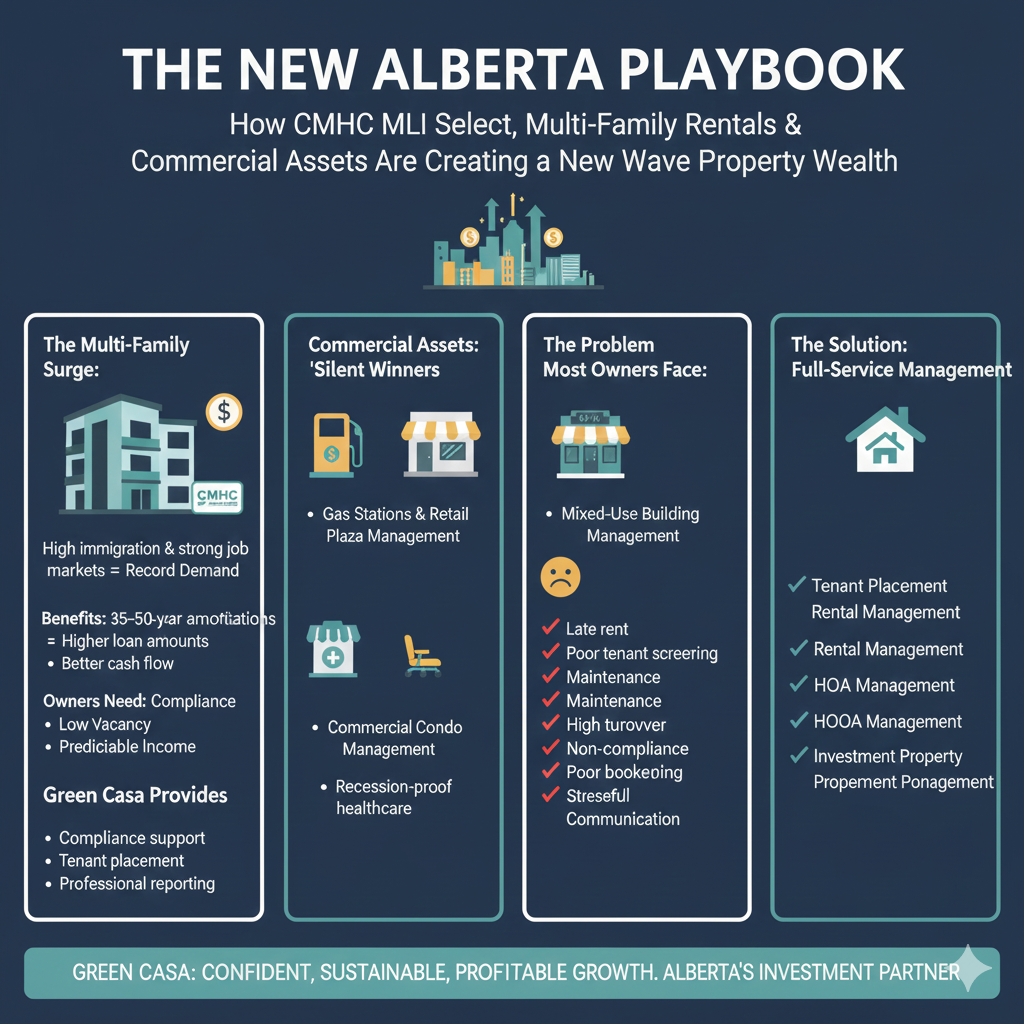

The Multi-Family Surge: Alberta’s Fastest-Growing Asset Class

High immigration, strong job markets, and affordable living are pulling record numbers of people into Calgary, Edmonton, Lethbridge, Red Deer, Airdrie, Chestermere, Okotoks, and Cochrane. That means one thing:

Multi-family buildings are in demand like never before.

But here’s the real game-changer:

CMHC MLI Select.

This financing program rewards buildings with:

- Energy efficiency

- Accessibility

- Social affordability

- Overall long-term rental stability

And the benefits are massive:

- 35–50-year amortizations

- Lower debt-service thresholds

- Higher loan amounts

- Better cash flow stability

But qualifying isn’t automatic. Owners need:

- Proper documentation

- Strong tenant management

- Predictable rental income

- Compliance and building standards

- Reduced vacancy risk

This is exactly where Green Casa steps in with:

- Full rental management services in Calgary

- Landlord support for compliance

- Tenant placement systems that minimize risk

- Professional reporting lenders love

MLI Select is powerful, but only when the building runs smoothly.

Why Commercial Assets Are the “Silent Winners” in the Alberta Market

Residential investing gets attention, but commercial properties often deliver stronger long-term returns, including:

1. Gas Stations & Retail Plaza Management

Gas stations in Alberta remain stable, high-traffic investments, especially along:

- Highway corridors

- Growing suburban communities

- Towns surrounding Calgary

But mismanagement can turn a great location into a liability.

We support investors with:

- Leasing to fuel brands and convenience operators

- Environmental compliance coordination

- Vendor and contractor oversight

- Expense optimization and reporting

A properly managed gas station can remain a cash-flow machine for decades.

2. Mixed-Use Building Management in Calgary

Retail + residential = resilience.

Mixed-use properties in Calgary benefit from:

- Lower vacancy risk

- Balanced revenue sources

- Strong valuation increases

- Ideal positioning for newcomers looking for convenience-based living

Our role includes:

- Coordinating commercial and residential leases

- Handling two sets of regulations

- Maintaining the building to satisfy both tenant groups

These buildings thrive when the management is precise.

3. Commercial Condo Management

More professionals are buying units instead of renting office space.

This is especially common in:

- Legal firms

- Financial advisors

- Real estate teams

- Wellness clinics

- Specialist medical practices

We assist with:

- Bylaw enforcement

- Common area maintenance

- Coordinating repairs

- Financial oversight

- Board support

Owners gain peace of mind knowing the investment is protected.

4. Medical Office Building Management

Medical buildings have unique requirements:

- Higher HVAC standards

- Accessibility needs

- Longer leases

- Sensitive tenant operations

Our management approach ensures:

- Quiet, secure, compliant environments

- Predictable long-term tenant retention

- Strong capitalization value

Healthcare real estate is recession-proof for the investor who manages it well.

The Problem Most Owners Face: Unpredictable Tenants, High Turnover & Operational Pressure

Most investors don’t struggle with finding opportunities.

They struggle with maintaining them.

Common issues include:

- Late rent

- Poor tenant screening

- Maintenance delays

- High turnover in rentals

- Non-compliance with condo boards

- Underperforming commercial tenants

- Poor bookkeeping

- Stressful communication cycles

Even great buildings lose value when mismanaged.

The Solution: Full-Service Management Built for Alberta Investors

Green Casa Property Management provides a system that keeps properties profitable and predictable across Calgary and surrounding towns.

✔ Tenant Placement Calgary

High-quality renters, fast fill-rates, and low turnover.

✔ Rental Management Services Calgary

End-to-end handling of rent, maintenance, inspections, and compliance.

✔ Condo Management Companies Calgary

Support for investor-owned units and boards.

✔ HOA Management Calgary

Perfect for townhouses and condo-style neighborhoods.

✔ Investment Property Management Calgary

Reporting that supports lenders, accountants, and long-term refinancing strategies.

The Alberta Advantage Is Clear: Long-Term Stability Starts with Smart Management

Whether you’re investing in multi-family buildings under CMHC MLI Select, operating a gas station, buying a commercial condo, or developing a mixed-use building, the difference between success and headaches comes down to one thing:

Expert management.

Green Casa gives investors the foundation they need to grow, confidently, sustainably, and profitably.