Introduction: The “Value Gap” Opportunity

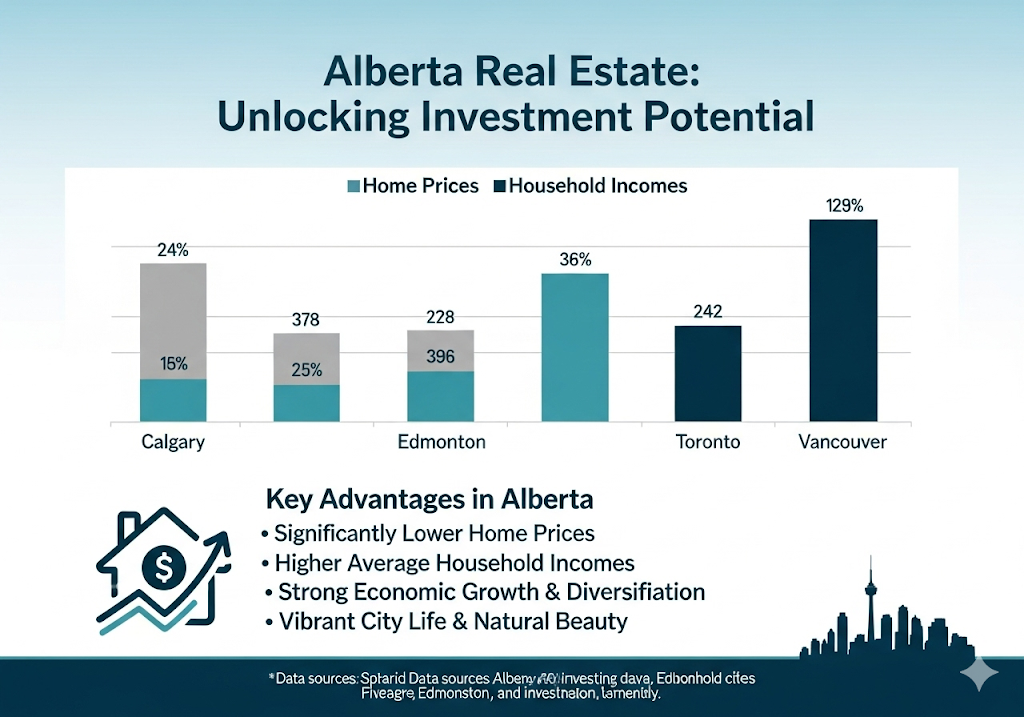

Across much of Canada, the dream of homeownership is slipping further from reach. In Toronto and Vancouver, bidding wars and million-dollar price tags dominate conversations. But in Alberta, a very different story is unfolding.

Here, affordability isn’t just a memory; it’s a reality. Calgary and Edmonton, Alberta’s two largest cities, combine lower housing costs with strong incomes, creating what can only be described as a “value gap” compared to the rest of the country.

For homeowners and investors alike, that gap isn’t just a statistic. It’s an opportunity.

Breaking Down the Price Advantage

Numbers tell the story clearly:

- Toronto/Vancouver MLS Benchmark (late 2022): ~ $1.1M+

- Calgary MLS Benchmark (late 2022): ~ $527,000

- Edmonton Average Home: ~ $400,000

What this means in real terms:

- For the price of one property in Toronto, an investor could buy two in Calgary or nearly three in Edmonton.

- This lower entry point allows investors to spread risk across multiple properties, diversify their portfolios, and scale faster without stretching finances to the breaking point.

In markets like Toronto or Vancouver, investors often struggle to make the math work. In Alberta, the math finally works in their favor.

The Income Advantage: Residents Can Actually Afford It

Affordable homes don’t mean much if the local population struggles to pay rent. Alberta stands out because its affordability is matched with strong earning power.

- Calgary’s median after-tax household income: ~ $87,000, the highest among major Canadian cities.

- By comparison, in Toronto or Vancouver, household incomes often sit closer to $70,000–$75,000, despite housing costs being double or triple.

This creates one of the best income-to-housing ratios in Canada. For renters, it means they aren’t overstretched. For landlords, it means tenants can reliably afford rent payments.

In plain terms: Alberta isn’t just affordable, it’s sustainably affordable.

Investor Advantage: Where the Numbers Work

The combination of low purchase prices and high household incomes creates a rare sweet spot for investors.

Here’s why Alberta’s cities stand out:

✅ Cash Flow Potential

In many Canadian markets, investors bleed cash each month, hoping future appreciation will save them. In Calgary and Edmonton, lower mortgages and strong rents mean investors can achieve positive monthly cash flow today.

✅ Demand Stability

High incomes support healthy rental demand. Couple this with steady population growth, fueled by interprovincial migration and international immigration, and investors enjoy a tenant pool that’s both growing and financially stable.

✅ Balanced Growth

Unlike overheated markets prone to sharp corrections, Alberta’s housing markets move more steadily. This balance gives investors the rare chance to capture both cash flow and appreciation over time.

Recognition of Value: It’s Not Just Local Buzz

Alberta’s value proposition hasn’t gone unnoticed.

MoneySense, one of Canada’s most trusted financial publications, ranked:

- Calgary: 3.69/5 value score

- Edmonton: 3.44/5 value score

These rankings place Alberta’s major cities among the best in the nation for long-term value. In a country where affordability is becoming an exception, Alberta is setting the standard.

Conclusion: The Right Market at the Right Time

Across Canada, affordability is slipping away. But in Alberta, the story is different. Calgary and Edmonton offer a rare combination of:

- Homes at half the price of Toronto or Vancouver.

- Incomes that rank among the highest in the country.

- Stable, growing markets that balance cash flow and appreciation potential.

For investors, the choice is clear: Alberta is the market where the numbers finally make sense.

In real estate, timing is everything, and right now, Alberta offers one of the strongest value opportunities in Canada. Your dollar stretches further, your portfolio grows stronger, and your future looks brighter.

Sometimes, the smartest move isn’t chasing the biggest headlines; it’s investing where the numbers don’t lie.