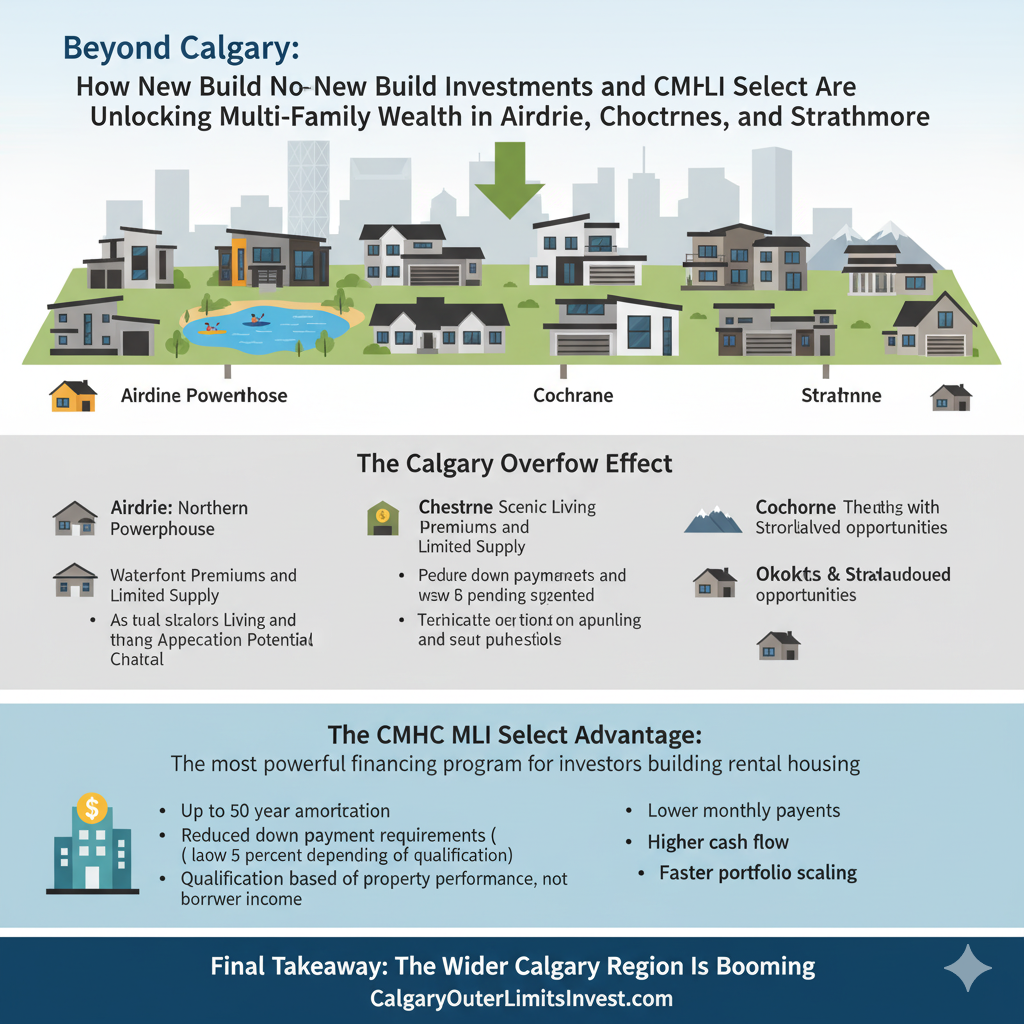

Beyond Calgary: How New Build Investments and CMHC MLI Select Are Unlocking Multi-Family Wealth in Airdrie, Chestermere, Cochrane, Okotoks, and Strathmore

Calgary is expanding quickly, and surrounding towns are capturing the overflow. With rising housing demand, limited supply, and massive population growth, investors are setting their sights outside the city limits, where land is still affordable, and municipal approvals are faster.

The opportunity is simple:

Build rentals now while demand exceeds supply.

The Calgary Overflow Effect

Housing supply inside Calgary cannot keep up with rapid population growth. As a result:

- Young families and new residents are relocating to the surrounding towns

- Tenants are willing to commute for affordability and a larger living space

- Businesses are moving into these towns to capture population growth

These conditions create a stable rental market with low vacancy and strong rental income.

Airdrie: One of Canada’s Fastest Growing Rental Markets

Airdrie benefits from population migration, strong job creation, and a younger demographic profile.

Key investment characteristics:

- Higher rents on new builds because new tenants prioritize quality

- Strong returns on duplex and townhouse rentals

- High walkability to retail, services, and schools

Airdrie represents an affordable entry with high rental absorption.

Chestermere: Waterfront Premiums and Limited Supply

Chestermere’s competitive advantage is uniqueness. There is a finite number of lake-adjacent communities in Alberta. Properties near or around the lake capture premium rents because they offer lifestyle benefits tenants are willing to pay more for.

- Large detached homes secure long-term renters

- Excellent market for short-term furnished rentals targeting executives and remote workers

The scarcity of available land keeps values strong.

Cochrane: Scenic Living with Strong Appreciation Potential

Cochrane serves a growing commuter population who want more space and affordability while staying close to Calgary’s employment bases.

Investment opportunities include:

- Fourplex developments

- New townhome builds

- Rental communities targeting families

Demand is supported by a strong employment base plus lifestyle appeal.

Okotoks & Strathmore: The undervalued opportunities

These markets are not just affordable, they are early. Long-term price appreciation prospects are strong, especially as Calgary continues expanding south and east.

Investors entering now benefit from:

- Lower land cost

- Larger lots

- Limited competition

Early entry means capturing the value curve before price acceleration.

The CMHC MLI Select Advantage:

The most powerful financing program for investors building rental housing

MLI Select provides:

- Up to 50-year amortization

- Reduced down payment requirements (as low as 5 percent depending on qualification)

- Qualification based on property performance, not borrower income

For investors, this means:

- Lower monthly payments

- Higher cash flow

- Faster portfolio scaling

The program was designed to encourage multi-family rental creation in high-demand markets like Calgary and surrounding towns.

When combined with:

- Low land costs outside Calgary

- High rental demand from population migration

You get a market where new builds become highly profitable long-term holds.

Final Takeaway

Calgary is entering a prolonged growth cycle supported by:

- Economic diversification

- Population migration

- Housing supply imbalance

- Strong rental demand

Inner-city communities offer appreciation and redevelopment potential.

Surrounding towns offer affordable entry and powerful rental yield.

With CMHC MLI Select, investors do not have to wait for opportunities.

They can build them.