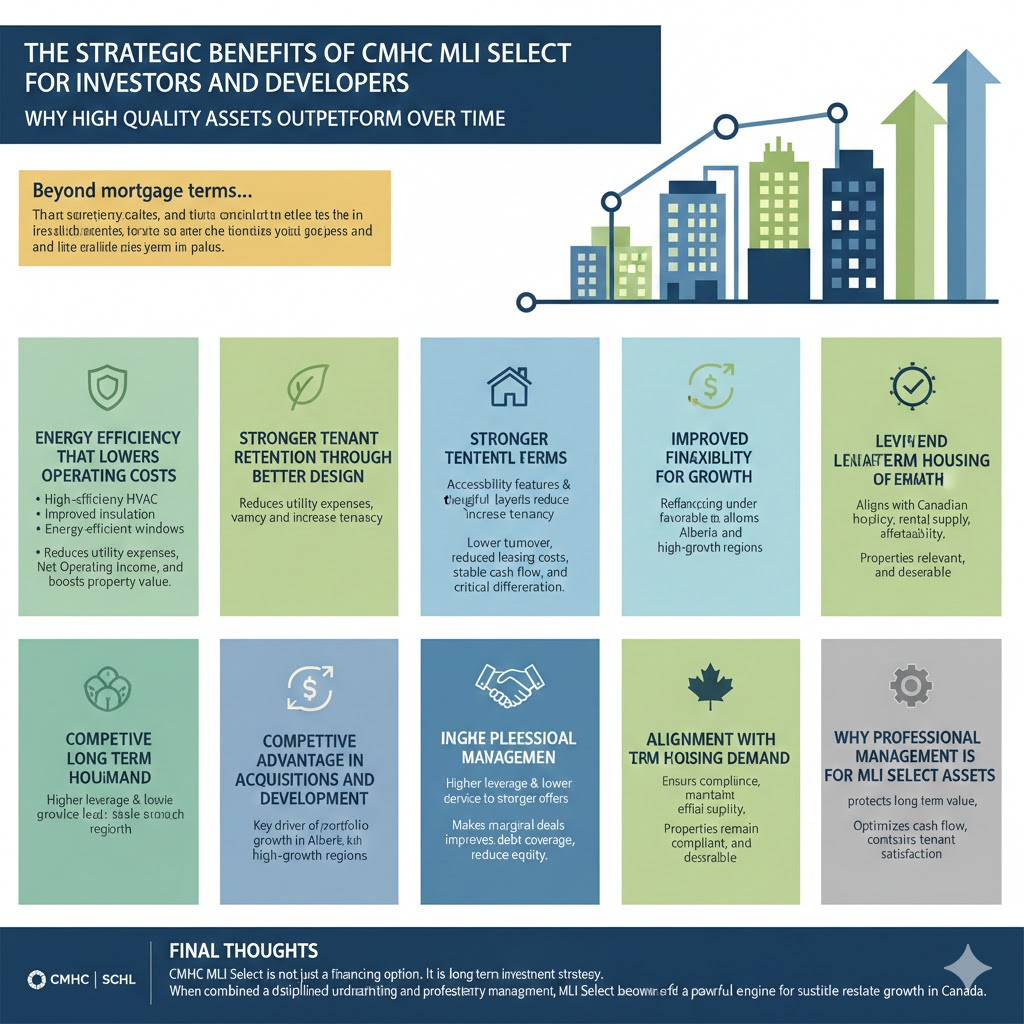

Why High Quality Assets Outperform Over Time

Beyond mortgage terms, CMHC MLI Select improves the fundamental strength of rental properties. The program incentivizes decisions that directly enhance asset performance, tenant retention, and long-term value.

Energy Efficiency That Lowers Operating Costs

Projects scoring well under MLI Select often include high-efficiency HVAC systems, improved insulation, energy-efficient windows, and water conservation measures.

These features reduce utility expenses year after year. Lower operating costs increase net operating income, which directly increases property value under income-based valuations.

For investors, energy efficiency is not just an environmental benefit. It is a long-term financial advantage.

Stronger Tenant Retention Through Better Design

MLI Select encourages accessibility features and thoughtful unit layouts. Buildings designed with a broader tenant base in mind tend to experience lower vacancy and longer average tenancy.

Lower turnover reduces leasing costs, minimizes wear and tear, and stabilizes cash flow. In competitive rental markets, tenant experience becomes a critical differentiator.

Improved Financing Flexibility for Growth

Assets financed under MLI Select often qualify for refinancing under similarly favorable terms. This allows investors to pull equity while maintaining healthy cash flow.

Refinancing flexibility is a key driver of portfolio growth, particularly for investors focused on multi-family expansion in Alberta and other high-growth regions.

Competitive Advantage in Acquisitions and Development

Investors using MLI Select can underwrite deals differently than competitors, relying on conventional financing. Higher leverage and lower debt service allow stronger offers without sacrificing returns.

In development projects, MLI Select often makes marginal deals feasible by improving debt coverage and reducing equity requirements.

Alignment With Long-Term Housing Demand

Canadian housing policy increasingly prioritizes rental supply, affordability, and sustainability. Assets aligned with these priorities are better positioned for long term demand and institutional interest.

MLI Select encourages investors to build properties that remain relevant, compliant, and desirable for decades.

Why Professional Management Is Critical for MLI Select Assets

Properties financed under MLI Select perform best when professionally managed. Effective property management ensures compliance with program requirements, maintains operational efficiency, and protects long-term value.

Experienced management teams understand how to optimize cash flow, control expenses, and maintain tenant satisfaction while preserving the integrity of the asset.

Final Thoughts

CMHC MLI Select is not just a financing option. It is a long-term investment strategy. For investors committed to building resilient, scalable, and cash-flowing multi-family portfolios, the program offers advantages that traditional financing cannot match.

When combined with disciplined underwriting and professional property management, MLI Select becomes a powerful engine for sustainable real estate growth in Canada.