Introduction

Buying your first 12-unit apartment building in Calgary is a leap into the big leagues of real estate. Unlike a duplex or triplex, the numbers are bigger, the risks are higher, but so are the rewards. And at the center of it all is one key decision: How do you finance the deal?

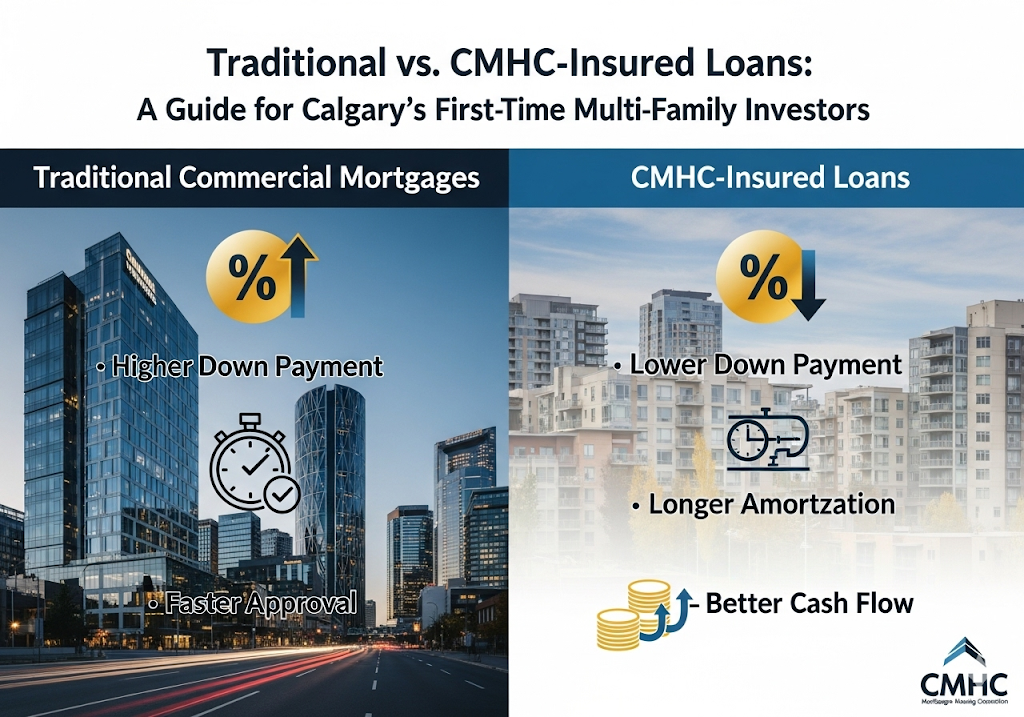

For first-time multi-family investors, two main financing routes exist: traditional commercial mortgages and CMHC-insured loans. Both can get you to the building, but the journey and outcomes are very different.

The Traditional Path: Commercial Mortgage

This is the “classic” way investors have financed for decades.

Typical terms:

- 25–30% down payment

- 20–25 years amortization

- Term renewal every 3–10 years

Why investors like it:

- Speed matters: Conventional financing can close in 4–6 weeks, making your offer attractive to sellers.

- Less paperwork: Banks mainly focus on your net worth, credit strength, and building cash flow—not on sustainability or affordability metrics.

- Best for value-add plays: If you’re planning to renovate units, raise rents, and refinance within 18–24 months, conventional financing is more practical.

Drawbacks:

- Cash-heavy: Ties up more of your capital.

- Higher payments: With shorter amortization, cash flow is squeezed.

- Renewal risk: Every 5 years or so, you renegotiate, often at higher rates.

The CMHC Path: Insured Financing for the Long Term

CMHC-insured loans, especially under the MLI Select program, have changed the financing landscape.

Typical terms:

- As low as 15% down (5% if strong affordability/energy criteria met)

- 40–50 years amortization

- Lower interest rates thanks to federal backing

Why investors love it:

- Cash efficiency: You control the same building with far less capital.

- Cash flow friendly: Long amortization = lower monthly payments = better stability.

- Rate protection: Lower interest rates mean you can weather downturns.

- Encourages responsible housing: Incentives align with social and environmental goals.

Challenges:

- Time-intensive: 3–6 months is common for approvals.

- Fees: Insurance premiums cut into short-term returns.

- Not for every building: Older properties may need upgrades to qualify.

Scenario: Two Investors, Two Choices

- Investor A (Conventional): Puts $600K down, closes in 45 days, and renovates units aggressively. After 18 months, refinances occur at a higher valuation.

- Investor B (CMHC): Puts $360K down, locks in a 40-year amortization. Lower monthly payments give them a stable cash flow to ride out any market bumps.

Both succeed, but the choice depends on personality and goals. Investor A is aggressive, Investor B is steady.

Why Calgary is the Ideal Test Market

- Population surge: Calgary is one of Canada’s fastest-growing cities thanks to interprovincial migration.

- Affordable entry prices: Multi-family buildings in Calgary still cost significantly less per unit than in Toronto or Vancouver.

- No rent caps: Investors can adjust rents to reflect market demand, improving pro forma projections for lenders.

- Pro-business policies: Alberta’s economy remains attractive to employers, ensuring strong rental demand.

Conclusion

For first-time apartment buyers in Calgary, the financing route you choose sets the tone for your investing career.

- Go conventional if you want speed, control, and flexibility.

- Go CMHC if you want to maximize leverage, lock in strong cash flow, and build long-term stability.

The good news? In Alberta, both doors open to a market with some of the best rental yields in Canada. The key is picking the financing path that matches your vision for the future.