Calgary’s rental market has transitioned from a cyclical opportunity into a structurally strong investment environment. While short-term headlines often focus on interest rates or temporary supply changes, the long-term fundamentals tell a more compelling story for rental property owners who understand market dynamics.

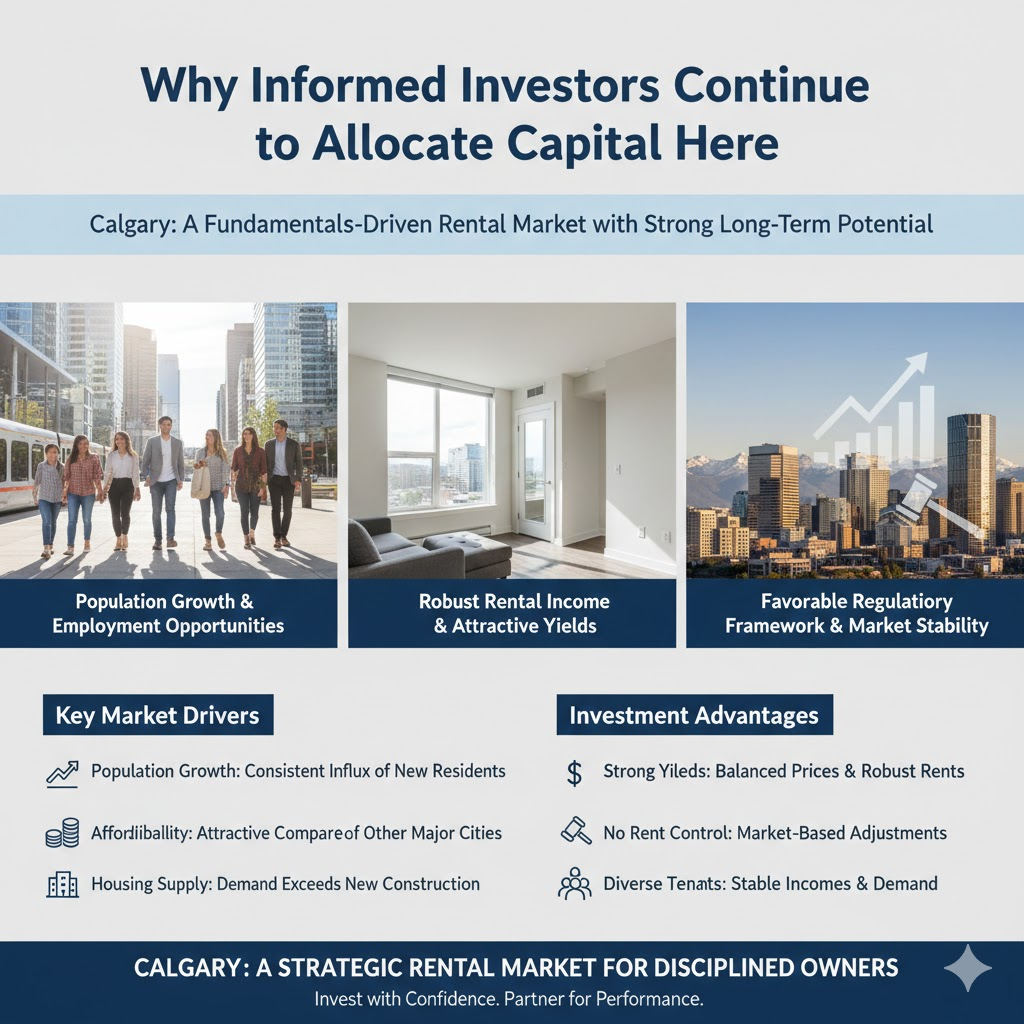

At the core of Calgary’s rental strength is population growth. Over the past several years, Calgary has consistently attracted new residents at a pace that exceeds new housing delivery. Migration has been driven by employment opportunities, relative affordability compared to other major Canadian cities, and a high quality of life. This imbalance between demand and supply has placed sustained upward pressure on rents.

Even with additional rental inventory coming online in late 2024, the market has remained resilient. Average rents have stabilized at elevated levels rather than correcting downward. Two-bedroom apartments averaging over $2,000 per month are no longer an exception in well-located communities. Single-family homes, particularly those with functional layouts and modern finishes, command premium rents.

One of Calgary’s defining advantages for landlords is Alberta’s regulatory framework. Unlike jurisdictions with strict rent control, Alberta allows market-based rent adjustments once per year. While frequency is regulated, there is no percentage cap. This structure provides investors with the ability to capture upside during strong economic cycles while maintaining predictability for tenants.

Rental yields in Calgary continue to outperform Canada’s largest metropolitan markets. In cities where purchase prices have escalated faster than incomes, yields are compressed. Calgary offers a more balanced equation. Acquisition prices remain comparatively accessible, while rental income remains robust. This creates opportunities for positive cash flow, particularly in suitable single-family homes and small to mid-sized multi-family properties.

Tenant demographics further strengthen the investment case. Calgary’s renter population includes young professionals, skilled tradespeople, students, healthcare workers, energy sector contractors, and new Canadians. Many renters have stable incomes and rent by choice rather than necessity, seeking flexibility or waiting for favorable buying conditions. This diversity reduces dependency on any single employment sector.

From an institutional perspective, the presence of universities, hospitals, and major employers creates a consistent baseline demand. As long as Calgary continues to add jobs and attract talent, well-positioned rental properties are likely to remain fully occupied.

For investors, the conclusion is clear. Calgary is not a speculative rental market. It is a fundamentals-driven environment where disciplined ownership and professional management can generate consistent returns.