Introduction: The Great Investment Migration

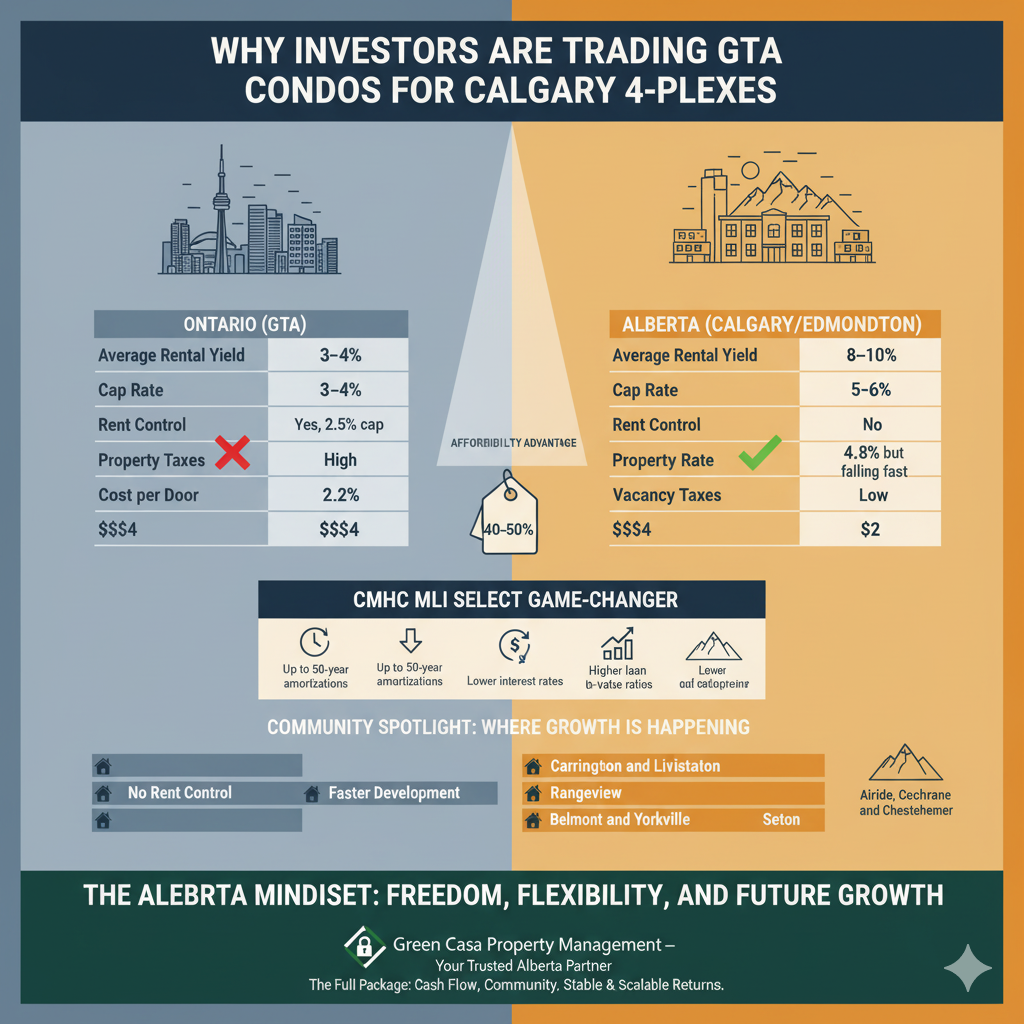

For decades, Ontario ruled Canada’s real estate map. But with shrinking yields and strict rent controls, many investors are starting to look west, toward Calgary and Edmonton, where the math just makes more sense.

Here’s why Alberta’s multi-family sector is quietly outperforming Ontario’s in 2025, and why both new and experienced investors are planting roots here.

1. Numbers That Speak Louder Than Hype

| Metric | Ontario (GTA) | Alberta (Calgary/Edmonton) |

|---|---|---|

| Average Rental Yield | 3–4% | 8–10% |

| Cap Rate | 3–4% | 5–6% |

| Rent Control | Yes (2.5% cap) | No |

| Property Taxes | High | Low |

| Vacancy Rate | 2.2% | 4.8% (but falling fast) |

| Cost per Door | $$$$ | $$ |

These figures reveal a simple truth: in Alberta, your money works harder.

2. The Affordability Advantage

In Calgary, a newer triplex or 6-unit building can cost 40–50% less than a similar asset in Ontario. That means less financing pressure and faster positive cash flow, a game-changer for younger investors entering the market.

3. The CMHC MLI Select Game-Changer

For younger buyers or small investors, the CMHC MLI Select program can be a secret weapon.

It rewards energy efficiency, accessibility, and affordability with benefits like:

- Up to 50-year amortizations

- Lower interest rates

- Higher loan-to-value ratios

Combined with Alberta’s low purchase prices and high rental demand, MLI Select makes building generational wealth more achievable than ever.

4. Community Spotlight: Where Growth is Happening

Calgary’s new-build neighborhoods are reshaping the city:

- Carrington and Livingston in the north are family-friendly and close to new amenities.

- Rangeview in the southeast, Calgary’s first “garden-to-table” community, is ideal for eco-conscious renters.

- Belmont and Yorkville in the southwest, great for new build duplex or rowhouse investments.

- Seton is the city’s “South Urban District,” close to the hospital and attracting working professionals.

Meanwhile, Airdrie, Cochrane, and Chestermere are expanding with new builds that attract young families seeking affordable rents with suburban comforts.

5. The Alberta Mindset: Freedom, Flexibility, and Future Growth

Unlike in other provinces, Alberta’s real estate model favors flexibility:

- Landlords can raise rents annually to meet market rates.

- Development regulations are faster and less costly.

- There’s no provincial land transfer tax or speculation tax.

In short, Alberta makes investing simpler, more profitable, and less restrictive.

Conclusion: The Smart Money Is Already Moving

Investors who once chased condos in the GTA or Vancouver are now eyeing multi-family assets in Alberta, because the numbers align with long-term success.

Whether it’s a trendy 4-plex in Killarney, a new build in Seton, or a purpose-built rental in Airdrie, Alberta’s market offers what Ontario can’t right now: room to grow, flexibility to adapt, and freedom to earn.